Ethereum fans may feel the price swings coming however, as Tron (TRX) founder Justin Sun reportedly unstaked $209 million worth of ETH from Lido Finance. If this proves to be true, the altcoin market could face sell-off risks, blockchain analytics platform Spot On Chain flagged.

Data on the blockchain indicates that Sun pulled 52,905 ETH from the liquid staking platform, Lido Finance, as part of a 543,865 ETH stash that he reportedly built between February and August 2024. Throughout this period, Sun purchased 392,474 ETH ($1.19 billion) from multiple wallets at $3,027 per token on average.

Major Ethereum Transfers To Binance Follow 5% Price Dip

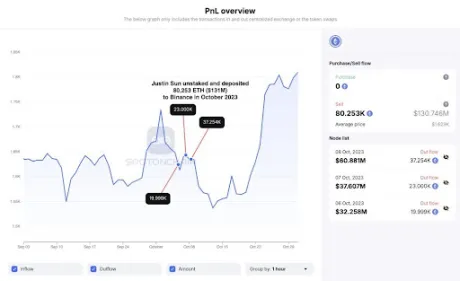

The total gross value of these holdings has risen by 29 per cent to $349 million, a profit. It is not Sun’s first major Ethereum move. The day after ethereum’s fall of 5% on October 24, he unstaked 80,251 ETH (worth $131 million) and sent the funds over to Binance.

Even by doing similar actions, Sun then deposited 19,000 ETH for $60.83 million in November, and 29,920 ETH for $119.7 million in January. The last seven days have been good for Ethereum, which has recovered steadily after a rough 3 weeks; gaining over seven per cent, and a steep 28 per cent in the past month according to CoinMarketCap.

However, since Sun’s history of large scale ETH movements has brought extra market volatility with it, major liquidations typically correspond to price decreases caused by excess selling pressure. But market watchers remain cautious because Sun’s actions could portend more selling even convincing other investors to follow suit.

The Tron founder has yet to share his own recent transactions, but the timing and amount of withdrawals he has made are causing Ethereum’s price movements uncertainty. Right now, if Ethereum is going to continue its upward momentum, it’ll depend on market stability and if prominent holders, like Sun, choose to hold or cut and run with their assets.