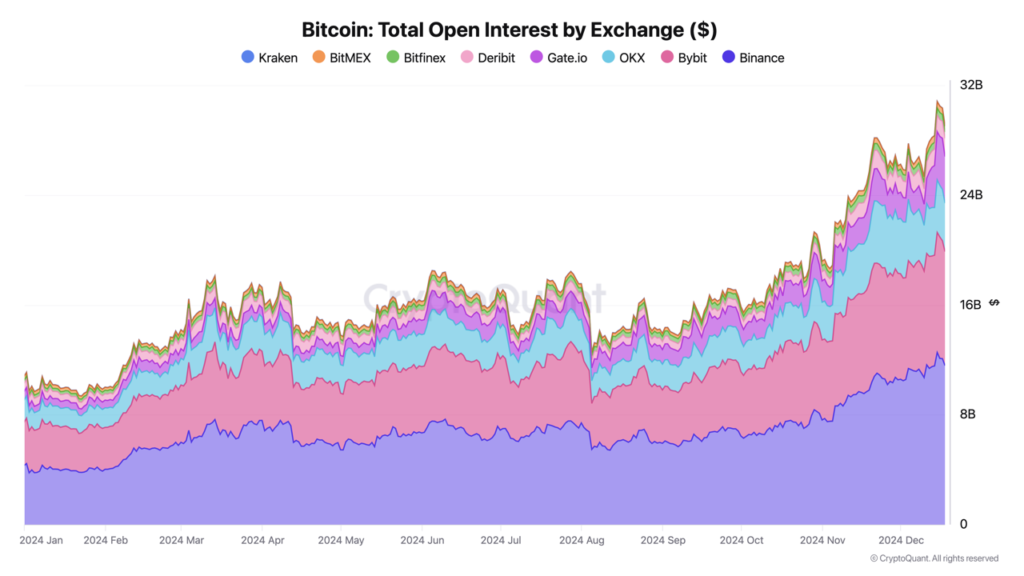

After recent downturns, Bitcoin is proving resilient and analysts expect to see trends in leverage and liquidity on the exchanges. These metrics are important for understanding market risks and opportunities as highlighted in insights from CryptoSQuant.

One thing I noticed about Binance is that they really make some good choices with liquidity management, having reserves above open interest basically 100 percent of the time.

Over this period, the total open interest for Bitcoin on the exchange grew from $4.45 billion dollar value in December 2023 to $11.64 billion dollar value in December 2024 with a stable leverage ratio of 13.5. It also beats out competitors greatly, a strong signal of Binance’s stamina during tumultuous times.

Bitcoin Traders Stay Cautious Amid Negative Premium Signals

As small exchanges, for example Gate.io, Bybit and Deribit are being scrutinised for their leverages that are 106, 86 and 32, respectively. Concerns about liquidity although such high levels are raised. That memory of FTX collapsing in late 2024, when it turned out to be massively leveraged with insufficient reserves, makes these concerns all the more amplified.

Another crucial market sentiment driver is the Coinbase Premium, i.e, the difference between what Bitcoin sells for on Coinbase and other exchanges. What this indicator of institutional demand does is provide a barometer of institutional demand. If there is a negative premium, traders are taking a cautious stance; if they are paying a positive premium, traders are becoming increasingly bullish more may be happening behind the scenes.

These figures show their Bitcoin open interest exceeds or approaches their reserves, with similar patterns observed for Ethereum.

Although Coinbase’s Premium is negative right now, traders remain cautious. CryptoQuant analyst BQVideo says that this indicator calls for you to stay on the sidelines until the point it shifts to positive territory which would be a sign of stronger demand. With Bitcoin near its next potential bull run, leverage ratios and institutional interest will set the valuation tone for the market.

If Binance is able to maintain its liquidity and leverage position, it will be market leader, while smaller exchanges will have to resolve their vulnerabilities to stay competitive. As traders, we will need to watch carefully the metrics such as the Coinbase Premium in order to navigate the cryptocurrency market.

You might miss few small trends with this approach but at least you can ride all the big trends and avoid losses in dips or downtrends.