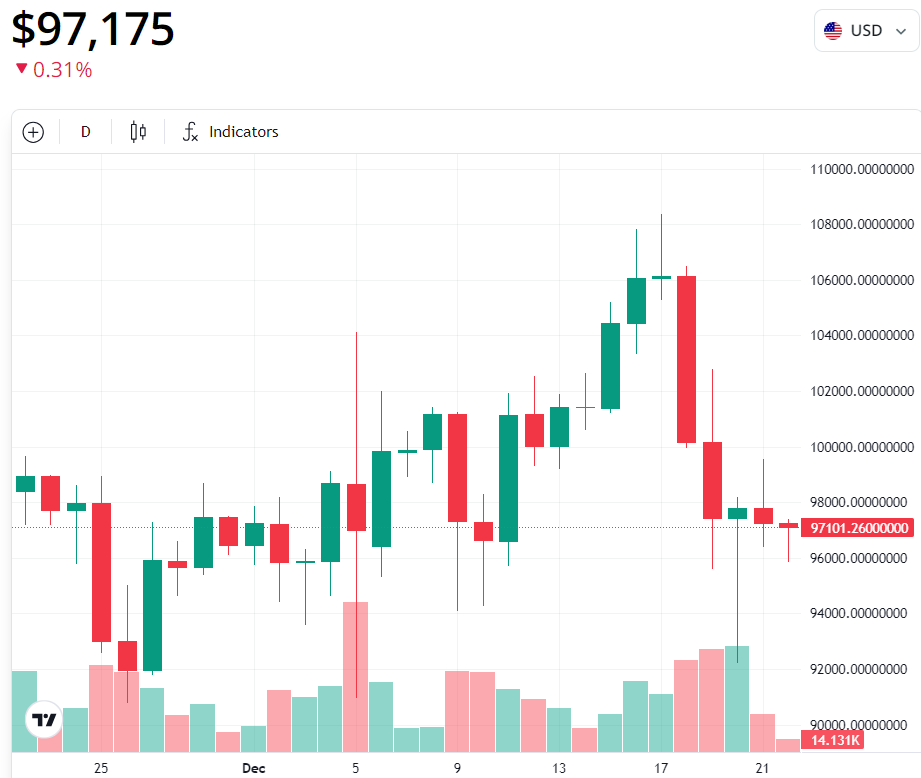

Recent market analysis suggests that Bitcoin’s social sentiment is at this year’s low, strengthening the theory of an imminent price recovery. At press time the cryptocurrency is changing hands below $97,150 after over a 10% decline from an all-time high on Dec. 17 of $108,300.

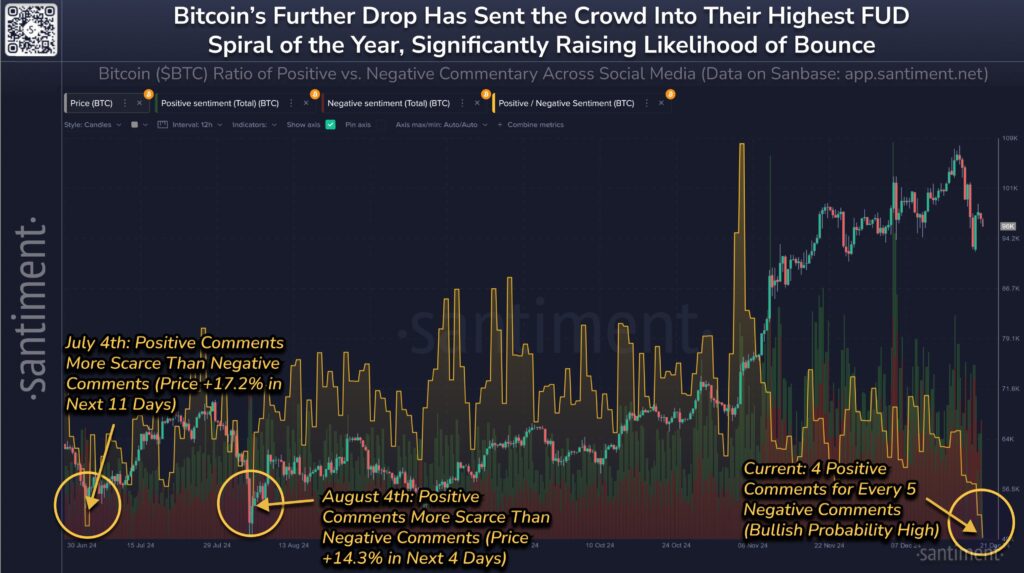

Santiment’s market intelligence platform saw a ‘very strong’ drop in Bitcoin related sentiment on social media, with the ratio of positive to negative comments being on average four to five. Such lows in retail investor confidence are historically preceded by major price movements.

“Vocal traders are now showing severe FUD, and that’s good news for contrarians who know markets move in the opposite direction of retail’s expectations.”

Bitcoin Predicted To Surge Higher

Some crypto analysts are predicting that soon Bitcoin’s current correction will be reversed and the cryptocurrency will recover to the $100,000 level. That drop fits with a three day streak of red candles on Bitcoin’s daily chart, not seen since early November, around the time of major global events, like the U.S. presidential election.

Chart analysts say Bitcoin could rebound with fractal patterns that can help identify historical price trends and reversals. This pattern was highlighted by popular crypto analyst Elja Boom on Dec. 20 in a Dec. 20 when he forecast a recovery above $100,000 in short term.

“We have seen this before.”

But while the correction can last another week until Bitcoin hits stable support, Rekt Capital shared historical data in a Dec. 21 post. While we may face short-term uncertainty; long term is optimistic.

“In 2017, Week 7 as well as Weeks 8 and 9 were also corrective. In 2021, Week 6 and Week 8 were corrective. Bitcoin is currently in Week 7 and slowly transitioning into Week 8.”

Using greater economic stability and easing of global monetary policies, a leading crypto services firm sees Bitcoin reaching around $160,000 by the end of 2025.

As BTC looks to make its way at least somewhat above $11,000 in the near term, there is a lot of support at the current level that may see the market become more volatile but could also be a setup for another gap higher before the end of 2020.