Asset manager VanEck said in a Jan. 6 report that a decentralized blockchain infrastructure called Hyperliquid, a Layer-1 blockchain network requires creating a passionate and skilled developer community to back the company’s $25 billion market capitalization.

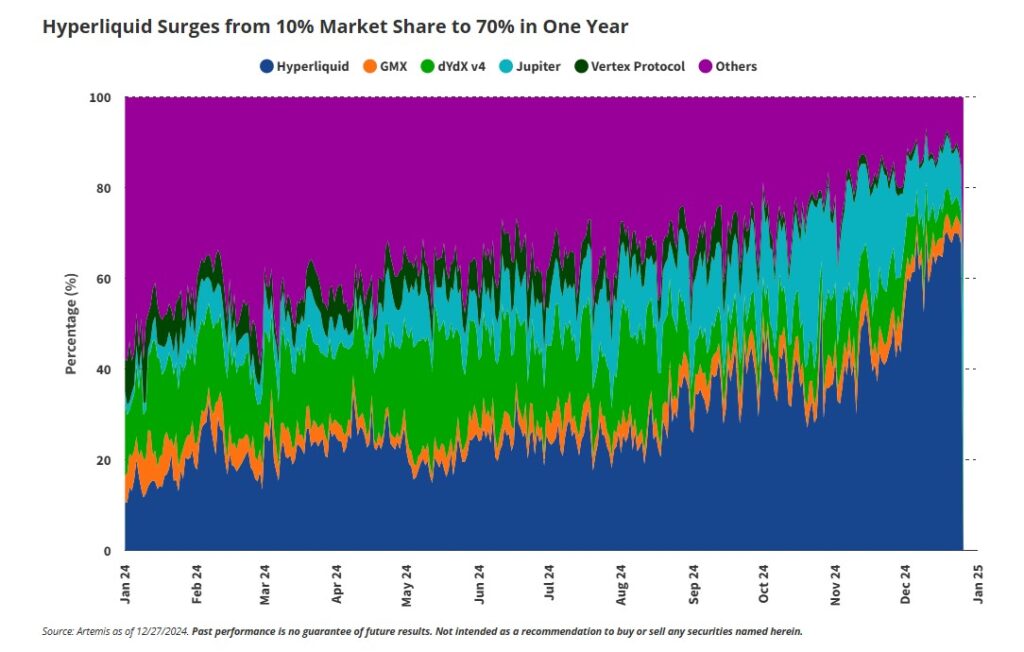

While the HYPE token and its perpetual futures exchange displayed early positive results, the network’s future development is uncertain due to a lack of developers. That is why, after the HYPE token airdrop in November, Hyperliquid has grown rapidly to dominate the perpetual futures market with around 70%, ousting competitors like GMX or Dydx, for example.

“Once again, we can see another Icarian tale about crypto hubris.”

Hyperliquid Boosts DEX Market

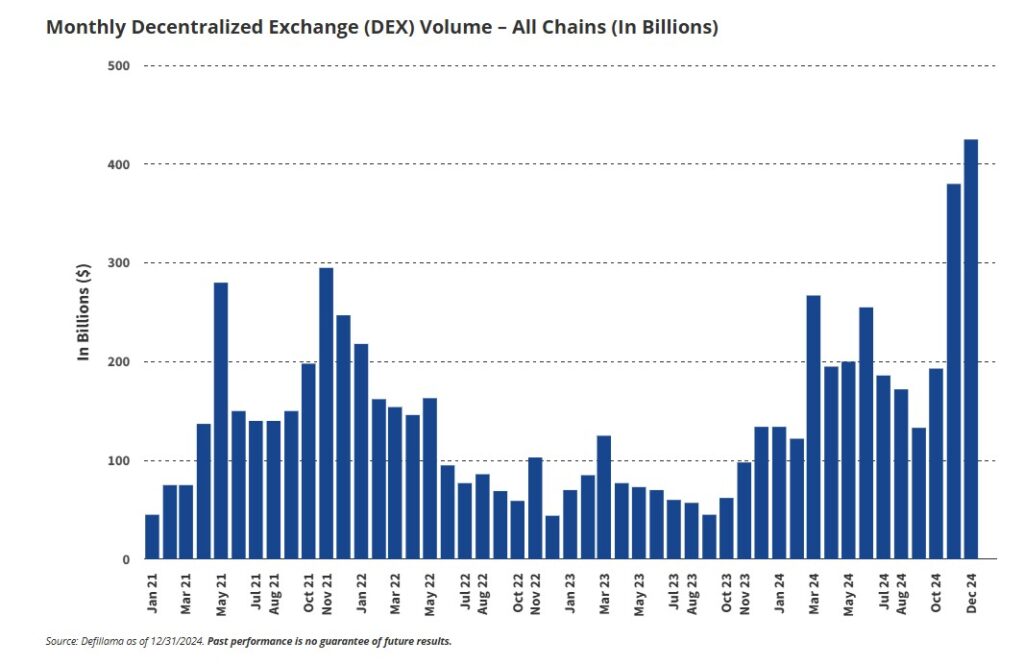

Its exchange now processes 260 million dollars daily, helping the decentralized exchange market, which had 433 billion dollars in turnover in December 2024. Perpetual futures also commonly known as “perps” that enable the trader to make a guess about the price of an asset without an expiry time, which is a speciality of Hyperliquid.

From its launch on November 29th to December, the HYPE token rocketed by more than 500%, reaching $34; as of January 7th, it is around $25, CoinGecko data shows. However, VanEck cautioned that Hyperliquid fully depends on its exchange since most DEXs lack sustainable competitive advantages, also known as long-term competitive moats, as the open-source space often allows features to be mimicked or cloned.

Hyperliquid success narrative has placed it at the 13th most valuable crypto project; maintaining this growth requires more people’s use. In response, Hyperliquid plans to establish an Ethereum Virtual Machine (EVM) compatible smart contract in 2025.

This feature remains instrumental when it comes to expanding its applicability into sectors other than trading and giving it the right valuation accessories. It is still early, yet at least six DApps are already running on EVM’s testnet, and some of them obviously have thousands of users, pointed out Web3 researcher ASXN.

According to VanEck, Hyperliquid should evolve into a general-purpose blockchain requires a developer community and support and multiple applications. Lacking these efforts, the platform threatens to fray out as BTHS did, albeit when it had dominated the perpetual futures market.