The recent bitcoin price dip down to $92,500 has been tied to increasing worries around the US Federal Reserve’s monetary policy tightening that may come to dominate the cryptocurrency’s price for 2025.

Bitcoin’s brief break from trading above $100,000 on January 7, which was the first time the coin had touched that mark since December 19, produced a dip, Markets Pro data showed.

Bitget Research chief analyst Ryan Lee said the correction was mainly due to heightened market anxiety around the Federal Reserve’s approach to monetary policy.

“Bitcoin’s dip stems primarily from strong US economic data pointing toward potential interest rate hikes. This development makes cryptocurrencies less attractive as investments, while the Federal Reserve’s signals of tighter monetary policy further intensify market corrections.”

Analysts Expect Bitcoin Rally After Short-Term Correction

Among the latest signs of US economic resilience, expectations of a rate cut have been pushed back, and pathways to a cut are growing more remote, with markets now betting that the Federal Reserve will not lower rates until June 18 as tracked by the CME Group’s Fed Watch tool.

Market forecasts expect interest rates to stay unchanged at the Federal Reserve‘s meeting next week, with a 95.2 percent probability.

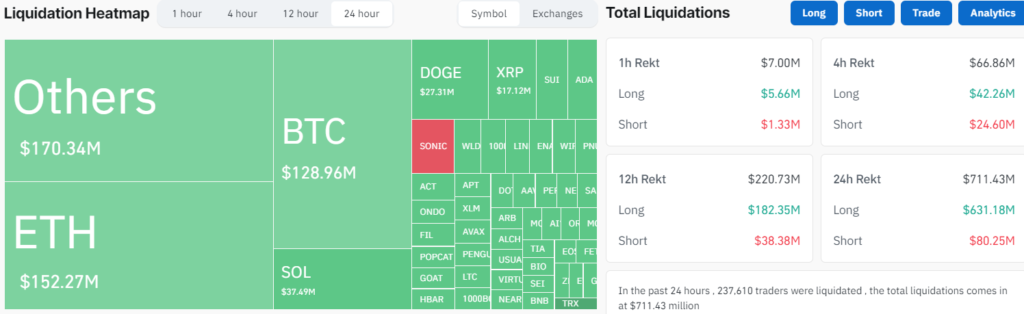

Ripple effect on the cryptocurrency market from this uncertainty policy. In the past 24 hours, liquidations above $631 million has been recorded across Bitcoin leveraged long positions, data from CoinGlass reveals.

Lee added that perhaps it was just too significant and could lead to a period of consolidation where traders recalibrate their leveraged positions.

“The interplay between macroeconomic indicators and crypto market dynamics will remain a critical factor influencing investor behavior and overall market performance in the coming weeks.”

While the short-term price drop is strong, Bitcoin long-time analysts remain optimists. According to some, the price can dip below $90,000 before soaring on a massive rally, in which case it will go even higher than $126,000. According to John Glover, chief investment officer at Ledn and former managing director at Barclays, Bitcoin may require another downturn to end the current lull in holiday illiquidity.

“This could lead us to test the $90,000 level again before the next significant move higher. Using wave analysis, we appear to be completing what I view as the fourth wave, suggesting a rally toward the $126,000–$128,000 range following this consolidation phase.”

This sentiment was joined by popular crypto analyst Rekt Capital, who warned that Bitcoin had to hold above the critical $91,000 support level to limit further downside risk.

“Bitcoin has failed its Daily retest, losing $101165 (black) convincingly as support. As a result, Bitcoin has reverted back into its $91000–$101165 range once again.”

While there are more bullish analysts forecasting a Bitcoin cycle, with prices potentially rising to $150,000 by late 2025, others warn that bitcoin can slide even lower in 2021. If $20 trillion of additional global money supply shows up, which Bitcoin investors have to invest their Bitcoin into to meet that rise, having already invested their Bitcoin into the cryptocurrency, that will add about $2 trillion into further growth of Bitcoin prices to new heights since the cryptocurrency had already gone up so much.