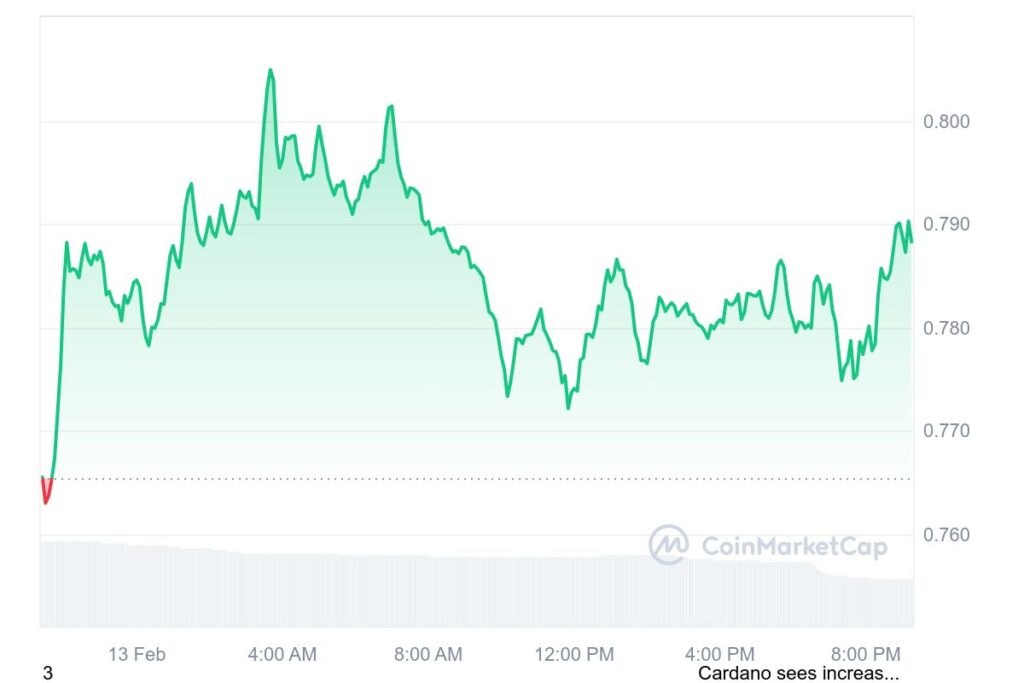

The cryptocurrency price for Cardano (ADA) reached $0.7879 during February 13, 2025 market session at a 2.2% rise against its previous closing rate. During this trading day ADA achieved its highest point at $0.8057 before reaching its lowest value at $0.7613. ADA demonstrates endurance through price fluctuations because it shows an upward projection over the last day.

The ADA cryptocurrency has demonstrated a 25.89% price decrease in the past month though its total worth today exceeds the values from one year ago by 40.23%. The long-term direction of Cardano remains optimistic even though bearish tendencies briefly dominate the market.

Technical Indicators and Market Sentiment

Relative Strength Index (RSI)

Presently the 14-day Relative Strength Index for Cardano maintains a value of 28.59 placing ADA within an oversold condition. The market demonstrates a potential price rally when these conditions occur because traders tend to view them as purchase points.

Moving Averages

The 50-day Simple Moving Average for Cardano stands at $0.9455 whereas its 200-day Simple Moving Average maintains a value of $0.6280. The mixed indicator from ADA’s price position regarding its relation to the 50-day Simple Moving Average (SMA) and 200-day SMA shows simultaneous short-term bearish and long-term bullish trends.

Fear & Greed Index

At present the Fear & Greed Index shows values at 44 indicating crypto market fear persists. The marketplace shows investor hesitation because numerous traders steer clear of risky deals. However, fear-driven markets often present buying opportunities for long-term holders.

Volatility

The volatility rate for ADA in the past 30 days reached 11.20% while its trading days were 43% positive. The cryptocurrency market shows natural price volatility and leads to abrupt price fluctuations which can occur in any direction.

Support and Resistance Levels

Key Support Levels

A downward correction of Cardano needs traders to monitor specific support points beginning at $0.6853 and moving through $0.6615 and finishing at $0.6288. A price break under these support levels could create further market downfall which might drive ADA into an increasingly negative position.

Key Resistance Levels

ADA encounters resistance barriers at the present trading levels of $0.7417, $0.7743 and $0.7981. A price breakout above the multiple resistance levels will enable ADA to rally further higher than $0.80 and possibly advance beyond that target.

Cardano (ADA) Price Prediction

Short-Term Price Prediction (Next 5 Days)

The market experts anticipate Cardano will experience an incremental price rise during the upcoming few days. The analysts predict ADA to rise to $0.8167 by February 18, 2025 when its price will experience a 3.65% increase from its present value.

Medium-Term Price Prediction (One Month)

The projected Cardano price movement indicates it will reach an estimated value of $0.9481 during March 10, 2025. Historical price trends together with technical indicators predict this potential breakout which corresponds to a 20.3% rise.

Long-Term Price Prediction (End of 2025)

Research analysts estimate ADA will attain prices up to $2.84 in 2025 while averaging $2.61 across the year. The forecasting relates to historical bull cycles and upcoming Cardano blockchain ecosystem enhancements together with general market patterns.

Conclusion

The current price decline of Cardano indicates potential recovery according to its technical indicators and historical trends. The RSI shows that ADA stands in an oversold position thus creating potential conditions for people to start buying. Analysts predict that Cardano could shift to bullish momentum during the following weeks if major resistance barriers are breached alongside market sentiment strength.

Predictions in the cryptocurrency market depend on technical analytical methods and historical market performance data though this market exhibits high volatility still. All trading and investment decisions need individual study combined with independent risk evaluation criteria.