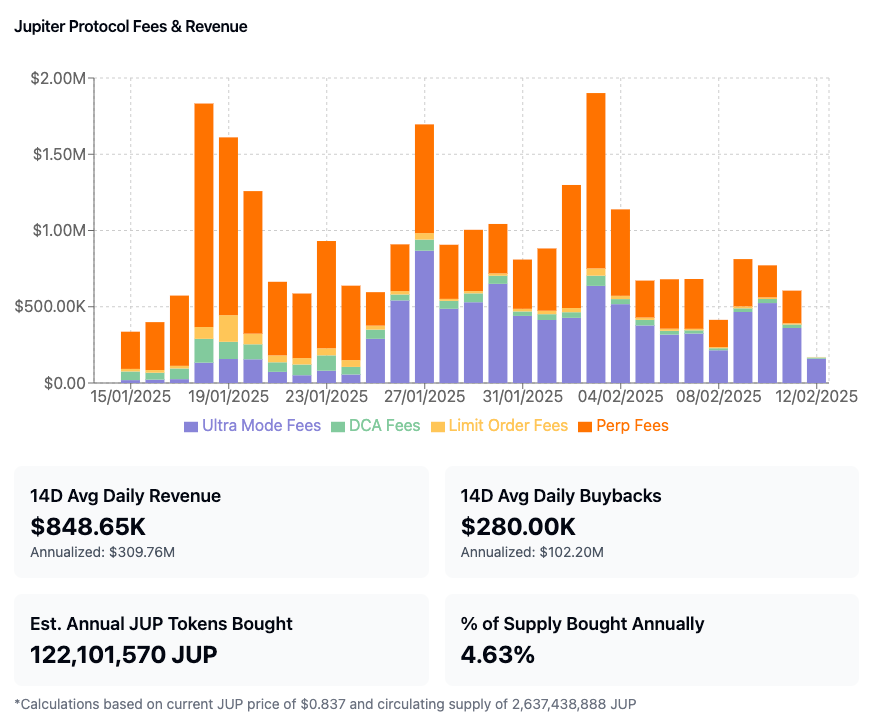

The research shows Jupiter will buy back $100 million JUP tokens every year as the leading Solana DEX aggregator. The announced purchase will result in new token demand lasting over time.

Jupiter held a public event on February 13 to tell its community why they would use company profits to buy back JUP tokens. The protocol begins buying JUP from February 17 with 50% of its collected fees. These purchased tokens will go into a three-year lockup period.

In his X comment Crypto researcher Aylo stated that regular token purchase initiatives boost JUP token valuation. “The steady growth in activity maintains Jupiter’s value while helping more buyers step in and making supply management work better” explained Aylo.

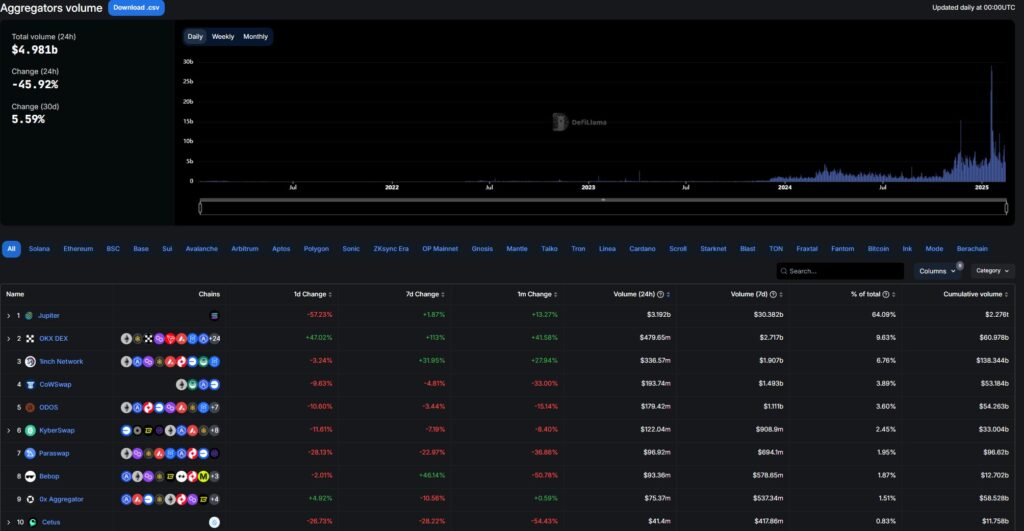

Jupiter Leads DEX Aggregators

Data from DefiLlama reveals that Jupiter leads all DEX aggregators by processing $3.2 billion worth of trades per day on February 14. The system earned $6 million through transaction fees since its first day in operation. Jupiter sends trades to multiple DEXs including Raydium to find optimal rates for its users while allowing them to manage automatic buy/sell orders based on specific conditions.

When Jupiter started its operations Solana experienced total volume growth because of increasing memecoin transactions. Native DEXs including Raydium on Solana have grown rapidly which makes them more active than Ethereum-based Uniswap DEXs over the past 30 days. DeFi protocol developers keep adopting revenue sharing methods because they show high demand.

DeFi projects Aave Ethena and Ether.fi use similar approaches to make their token owners more valuable. On November 15 Ethena stated that it would give part of its $200 million protocol revenues to its tokenholders. Ether.fi suggested in December to purchase ETHFI tokens using 5% of its earnings to reward its stakers. In January Maple Finance started working to distribute SYRUP tokens by repurchasing them from protocol revenue.

The rise of token buybacks results from the improved business conditions after Donald Trump won the November 5 election. The December announcement by asset manager Grayscale led DeFi projects to develop better methods of making money for their users.