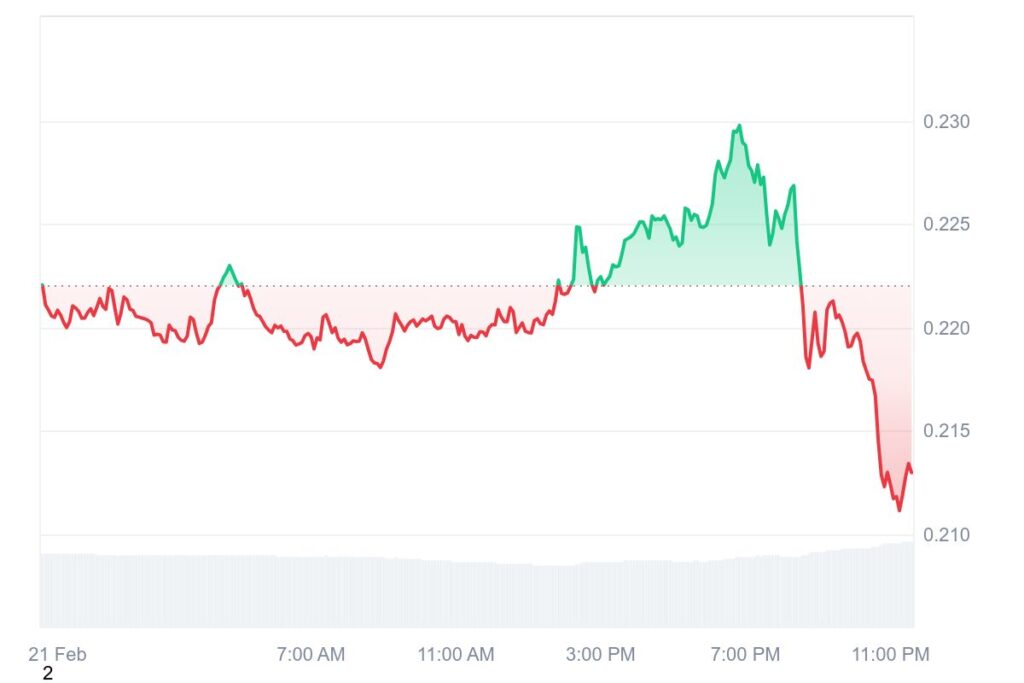

On February 21, 2025, Hedera (HBAR) shows a trading price of $0.212249 with a minor decrease of 0.04455%. During one day HBAR prices reached $0.229778 before falling to $0.211077, which shows average market volatility.

HBAR continues to be important for blockchain investors who follow both short-term and long-term price patterns of this crypto token. Market participants show a hesitant attitude, as buying momentum would return if specific technical thresholds are surpassed.

Technical Analysis

Support and Resistance Levels

HBAR is analyzing its performance around the $0.21 support level to decide its future price movement. The market will try to rise again towards $0.22 since this technical level has not been broken yet. Market players track $0.25 resistance as an important level because HBAR price gains above this barrier can drive the asset toward $0.28.

If $0.21 breaks down instead of holding its position HBAR might fall toward $0.20 which acts as a major psychological barrier. Falling prices toward $0.18 will build a more powerful downward heading for traders.

Moving Averages and Market Trends

The recent trading position below both short-term and long-term moving average indications ongoing bear market activity. The market uses $0.23 as its instant barrier with the 50-day moving average and $0.27 as its stronger barrier with the 200-day moving average. The market sees a bull reversal when HBAR breaks through both support barriers at $0.23 and $0.27.

RSI data shows that HBAR is neither strongly rising nor falling. It holds a reading of 42 from present readings. When the Relative Strength Index reaches 30 or below it suggests that prices are at an oversold point which may start a market recovery. The MACD indicator demonstrates that market selling activity exceeds buying demand because the MACD line remains beneath the signal line.

Market Sentiment & On-Chain Data

Investor opinions about HBAR include both positive and negative feelings as shown by the Fear & Greed Index reading at 55 (Greed). Investors keep holding positive beliefs on HBAR’s development despite its current price decline.

During the last thirty days HBAR saw a 43% trend where prices closed higher than the opening value in 13 trading sessions. Despite fluctuations of 16.51 percent HBAR shows strong price variation.

Short-Term Price Prediction

HBAR price trends will depend on if it stays above $0.21 support or breaks through $0.22 resistance in the next several days.

The token market will likely go up from $0.22 toward $0.25 when the next few days pass in favor of the bulls. As HBAR remains under $0.21 the price will probably decrease and go down towards $0.20. The market direction depends on how intense trading happens and what factors drive the momentum.

Medium-Term Prediction for the Coming Weeks

Experts believe HBAR will increase toward $0.28 to $0.30 based on rising buying momentum. Strong buying needs to pass through $0.25 because this level still blocks price movement upward.

When HBAR breaks below $0.20 the price slide will stop near $0.18 as this level shows strong market support. Bitcoin’s behavior and investor feelings, together with the stock market, will shape HBAR’s price movements.

Long-Term Outlook for Hedera (HBAR)

HBAR price uncertainty for the next few weeks exists yet experts see positive growth over the long term. According to market experts HBAR stock may grow 62.86% by March 2025 when the market becomes bullish to $0.357759.

Expert market projections show HBAR prices reaching between $0.40 and $0.50 by 2025 if Hedera blockchain adoption continues growing and investors keep investing in its technology. The expected success depends heavily on organizations starting to use HBAR more often, plus creating partnerships while valuable market events add to this development.

Final Thoughts

The current trading status of Hedera shows a market position between being neutral and bearish. Its vital levels include $0.21 support and $0.22-$0.25 resistance. The market should stay neutral but improve when HBAR increases its usage along with progress in blockchain networks.

Today’s market performance will establish what direction HBAR next takes. The price staying above $0.21 may produce stability and push the market towards $0.25. The price of HBAR will likely continue falling if traders push it under $0.21.