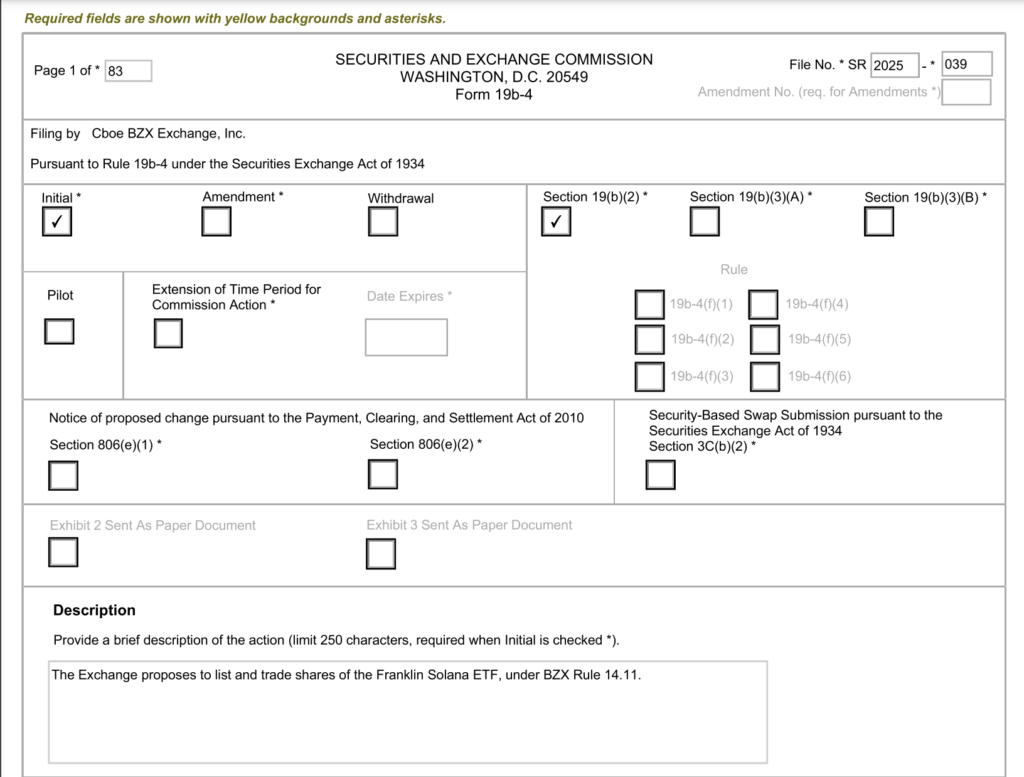

Under an application from Cboe to the SEC Franklin Templeton seeks to launch a Solana ETF on the exchange. The filing filed March 12 indicates Franklin Templeton wants to launch an ETF holding Solana coins and stake assets for rewards through the SEC.

The legal filing claimed that stopping staking as if it were equal to blocking income distribution resembles an ETP rejecting company dividends. Franklin Templeton started working with Solana on February 10 and joined other firms pursuing Solana investments before them.

The crypto industry shows enthusiasm for Solana ETFs as former SEC Chair Gary Gensler stepped down from his position in January 2025. Multiple crypto ETF firms submitted their applications after his departure because they expect better financial rules when President Biden takes office.

SEC Delays Altcoin ETF Decision

However, the SEC remains cautious. On March 11 the regulator temporarily postponed its decision about various altcoin ETF proposals including Solana, Litecoin, Dogecoin, and XRP. The SEC needed more time to analyze the new rule suggestions submitted to its agency.

According to James Seyffart of Bloomberg ETF his delay was a typical step required to review the application without altering the odds of receiving approval from the SEC. Seyffart explained that these altcoin ETFs need regulatory approval before October 2025 so there is enough time for regulators to review them.

The changing views held by US government agencies shape cryptocurrency ETF success. Donald Trump put Solana into his initial crypto stockpile plan but made a change later to keep only cryptocurrencies seized from lawbreakers.

The Trump administration’s approaches to blockchain technology make Franklin Templeton CEO Jenny Johnson eager about integrating digital finance. She stated in her January 21 interview with Bloomberg the blockchain technology will power all future ETF and mutual fund infrastructure because of its superior efficiency.

SEC’s conclusion about Franklin Templeton’s Solana ETF will determine other altcoin fund terms and guide cryptocurrency investment products in the US.