Sellers are increasingly inactive as the BTC price approaches a level that is only 15% from the all-time high. These are hits on-chain data from the analytics platform CryptoQuant..

As of September 25, this is the lowest figure within the sell-side risk since the beginning of 2024, showing that most of the owners are still holding the coins and are not selling them in spite of the recent price changes.

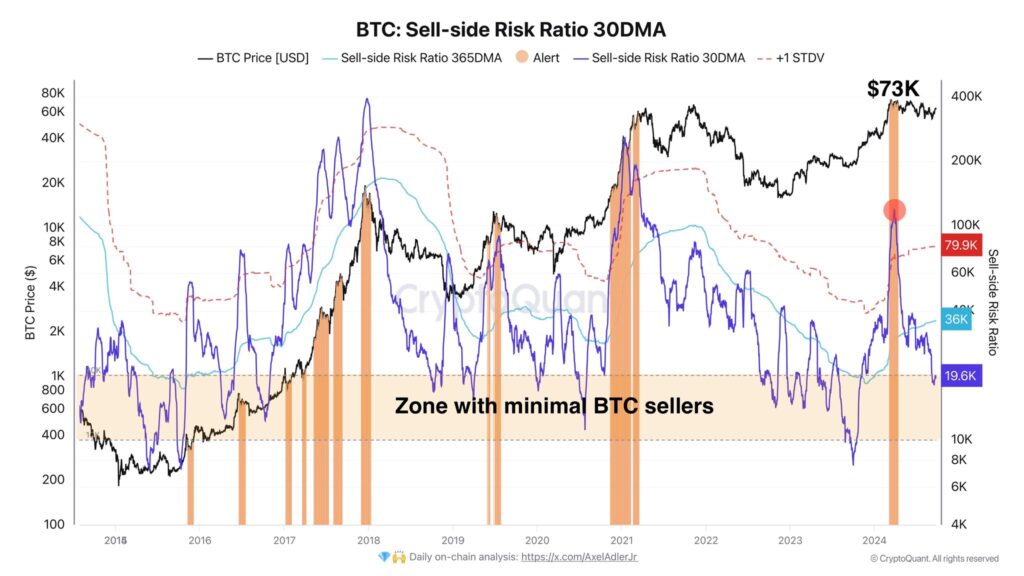

Bitcoin Sell-Side Risk Drops

Crypto-Quant Axel Adler Jr. noted that from the top of ever 73,000 USDT for bitcoin, there has been a scarcity of potential sellers. The sell-side risk ratio which is measuring the short term or daily profit and loss vs bitcoin’s perceived upper limit by the market has gone down below twenty thousand.

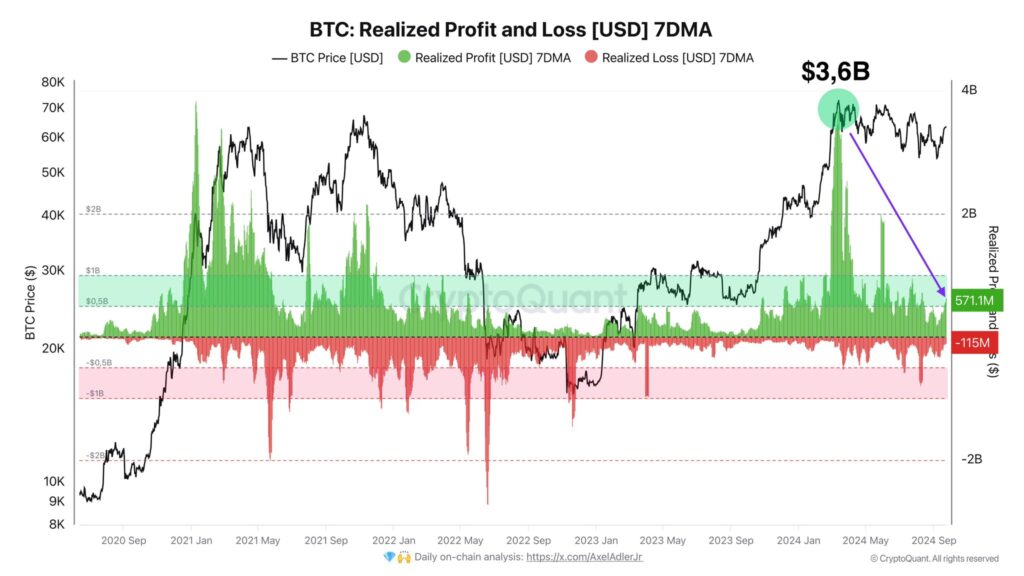

This is quite a drop from the previous March monthly high where it was approximate eighty thousand. However, activity on the network is not inactive, as per the chain, the daily realized profit and loss is on net daily rotation of 500 million after a slowdown from the 3.6 billion mark in March.

“On average, Bitcoin generates around $571M in profits each day, compared to $115M in losses. The net average profit investors are making is measured at $456,000,000 per day.”

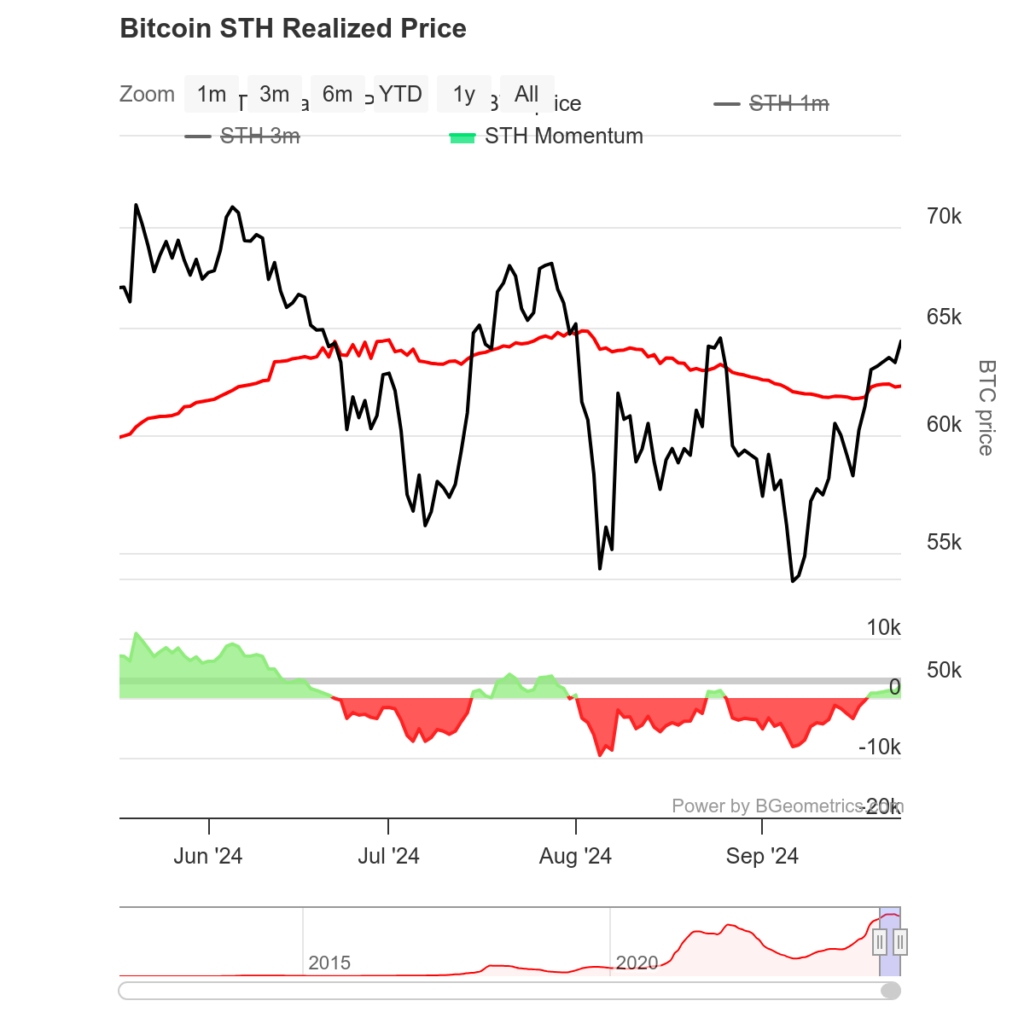

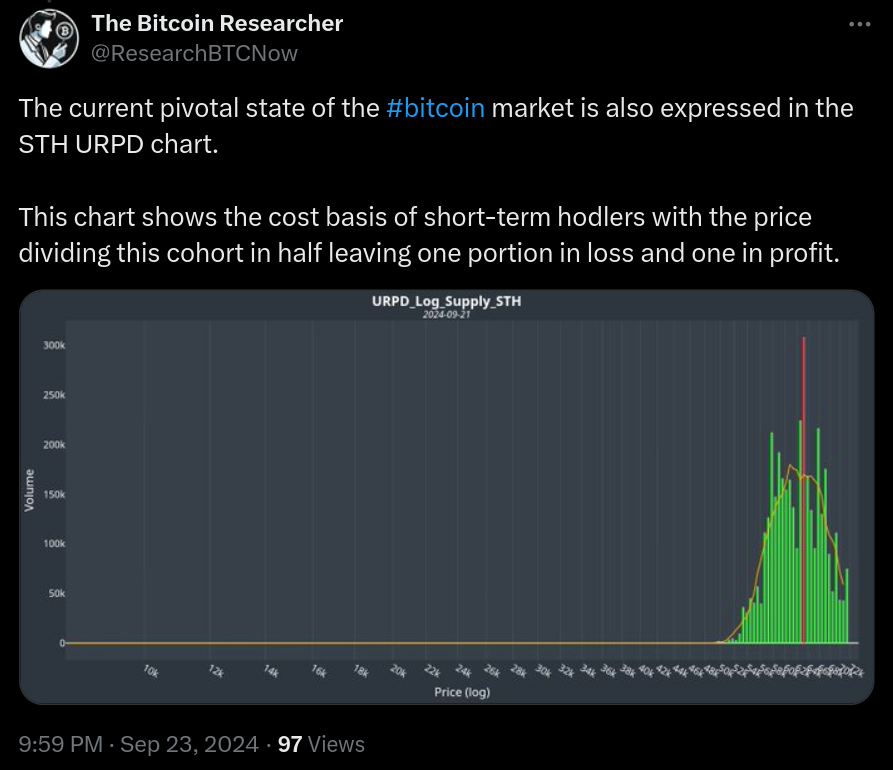

Adler stressed that the network remains in an active state and there is no reason that it is towards a leaning sraph active phase. BGeometrics data indicates that short-term holders (STHs), who belonged to the group earlier this year that had suffered prolonged uncertainty and extended losses, are now back in the profit taking at a cost basis of approximately $62,250.

Such shifts in STHs behavior are deemed fundamental to establishing Bitcoin price ranges in the future. It has been pointed out by analyst that the current market state for Bitcoin dynamics is extremely interesting, and there is further speculation where the price of the asset would go as sellers of the crypto asset were not in a hurry to sell.