According to the CEO and founder of CryptoQuant, Ki Young Ju, Bitcoin’s current mining hashrate capable of supporting a market cap of $4.9 trillion.

In a post on X that analyzes the data, the author demonstrates the use of a pricing model which associates Bitcoin’s value range with current trends in mining hashrate, the combined total computational power being used to secure the blockchain.

It’s a race game for bitcoin miners trying to solve complex puzzles in order to earn rewards, in the form of cryptocurrency pushing them further and further along the chain. But the cryptocurrency’s security, and the intrinsic value of the cryptocurrency itself, depending on some experts, is based on the mining activity.

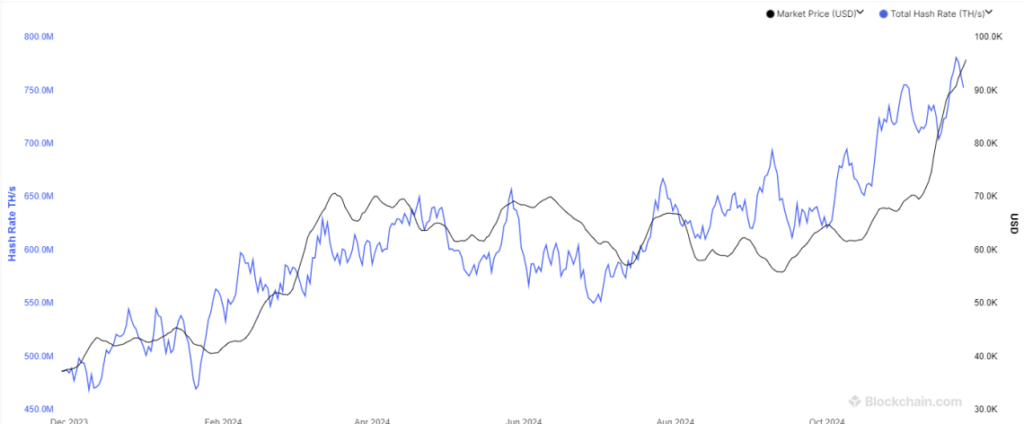

Bitcoin Mining Hashrate Rises Steadily

Bitcoin’s mining hashrate continues to rise and has met recent all time highs due to the cryptocurrency’s price rally, according to recent data. Pricing model takes into account periodic halvings, which roughly occurs every four years that halve miners’ block reward and reduce their BTC revenue at the same time.

In his model, Ju calculates BTC upper and lower market cap boundaries using historical ratio of adjusted hashrate and market value. Using current market cap of about $1.9 trillion, Bitcoin’s 38 percent current market cap is now 38 percent of the model’s estimated peak, or room for further growth.

The model also amounts to a prediction that the 2021 bull market did not hit the theoretical upper bound and that current and future cycles may not always reach the $4.9 trillion ceiling. But Bitcoin’s ratio to its maximum historical market cap is still far more below its current than it has been at any point in the past month, suggesting some upside to the rally.

The chart notably shows mining dynamics responding with sharp hashrate drops at past Halving events in 2016, 2020, and 2024 indicating economic impact of the event.

Presently, the value of Bitcoin is at $94,400, which is 2% up this week.