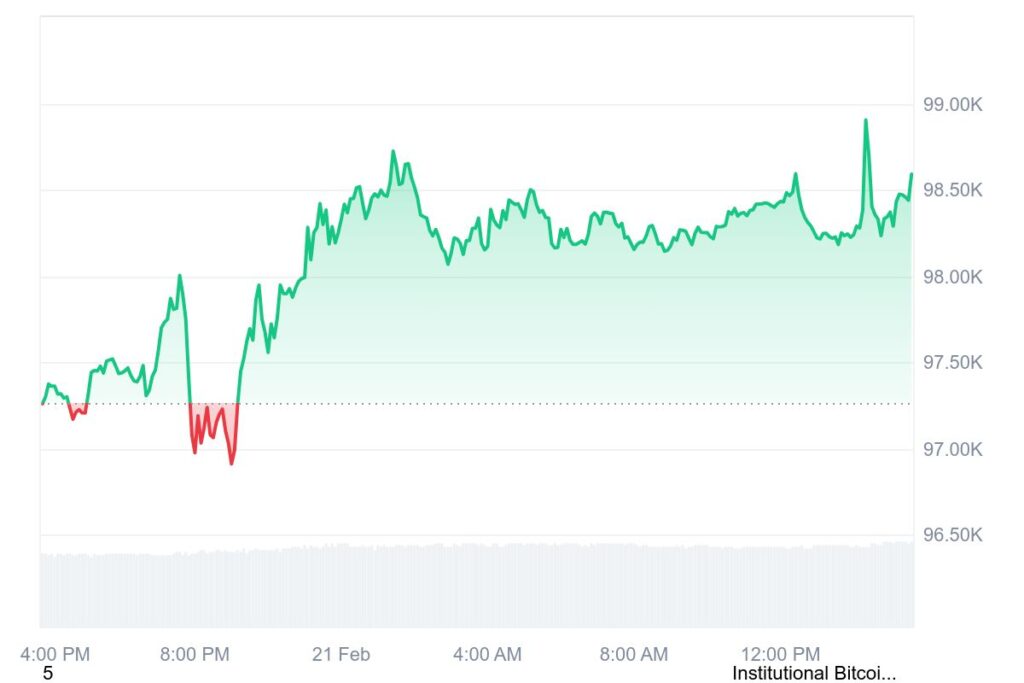

On February 21 Bitcoin (BTC) is worth $98,573 and its value has increased by 1.32 percent since the previous day. Bitcoin underwent substantial market changes between $98,980 and $96,862 as buyers and sellers intensified their activities.

Traders show positive outlook on Bitcoin but remain watchful because of market threats from rising inflation and possible Federal Reserve actions. Despite its 49.8% market dominance Bitcoin commands $1.94 trillion in market value and supports $35.6 billion of daily trades at present.

Bitcoin Price Performance in the Last 24 Hours

Bitcoin started trading at $97,292 today and reached $98,573 within the day. The buying activity during marketplace operations pushed BTC toward $98,980 before buyers pushed it back down. The present upward trend suggests Bitcoin will reach over $100,000 in price by the near future.

Bitcoin stays supported around $96,862 while market observers track this position for price movement. When the price drops below $96,862 it indicates a potential market shift toward $94,000 to $90,000.

Technical Analysis

Key Support & Resistance Levels

Bitcoin faces its main defense line at $98,000 although it keeps pushing higher. When BTC breaks above $98,000 the asset may move toward $100,000 to $101,500 later this period. Market participants will monitor $94,381 as an important support level because price might return to this area if it fails to maintain its current range. When sell-side impact grows BTC may drop to $90,000 in value.

Moving Averages & Trend Analysis

The Bulls maintain their control because Bitcoin trades higher than the $95,650 50-day moving average line. Both short-term and long-term market strength shows in its position above $92,100 chart for 200-day moving averages. The market will extend its upward push when BTC stays above both moving average lines.

Momentum Indicators

According to RSI indicators Bitcoin is showing signs of being overbought but has space left to increase in value as its current reading is at 62.8. When the RSI rises more than 70 it shows increased market strength while if it falls below 50 it suggests weakening buying power.

The MACD indicator showed buy signs to traders when its moving averages merged from different paths. Bitcoin continues to trade alongside the upper band of its Bollinger Bands which demonstrates high volatility at a healthy level.

Marlin Oscillator Prediction

The Marlin oscillator shows its attempt to reach trading levels above zero. When Bitcoin exceeds $101,954 it should move toward $104,617 to $105,417. If the market can maintain its upward movement through this barrier investors may see another visit of $109,986 from January 20.

Fundamental & Market Sentiment Analysis

Bitcoin experiences price changes due to both economic and basic market elements. Financial institutions increase their Bitcoin buying habits to support its market value. The launch of Bitcoin spot ETF products poured substantial capital into the market leading to greater demand and reliability.

Investors buy Bitcoin as a safe store because they fear rising prices and Federal Reserve rate changes in regular markets. Falling Bitcoin reserves on exchanges show that investors prefer to keep their BTC instead of selling because this trend supports positive market prospects for the future.

Bitcoin Price Prediction

The current market actions and trading signals show Bitcoin staying between $94,000 and $100,000 today.

Bitcoin has good chances to reach $101,500 after clearing $98,000 within 24 hours. Selling power increases when BTC price drops below $94,381 and pushes the cryptocurrency value downwards toward $90,000 to $92,000. Traders need to pay attention to the main price barriers and floor points as they watch market actions.

Conclusion

Bitcoin keeps advancing up in price with its core barriers at $98,000 and the $100,000 round number level. As Bitcoin continues its upward trend it may reach between $105,000 and $110,000 within the following weeks provided that purchasing pressure remains high. Major market turbulence and worldwide economic changes may lead to brief market drops.

Active traders and investors need to watch technical patterns combined with economic information to take effective market positions properly. The digital economy grows stronger as both large investment firms and everyday buyers invest in Bitcoin.