Bitcoin drops sharply right now because both BTC and other cryptocurrencies receive strong selling activity. A decrease from its $90,000 peak forced Bitcoin to tumble through its $80,000 support level and worry investors. Many economic and market-specific aspects created this market decrease. This piece deeply examines Bitcoin’s market state by reviewing BTC’s latest value, investing patterns, market problems, and price projections for today.

Bitcoin Price Overview

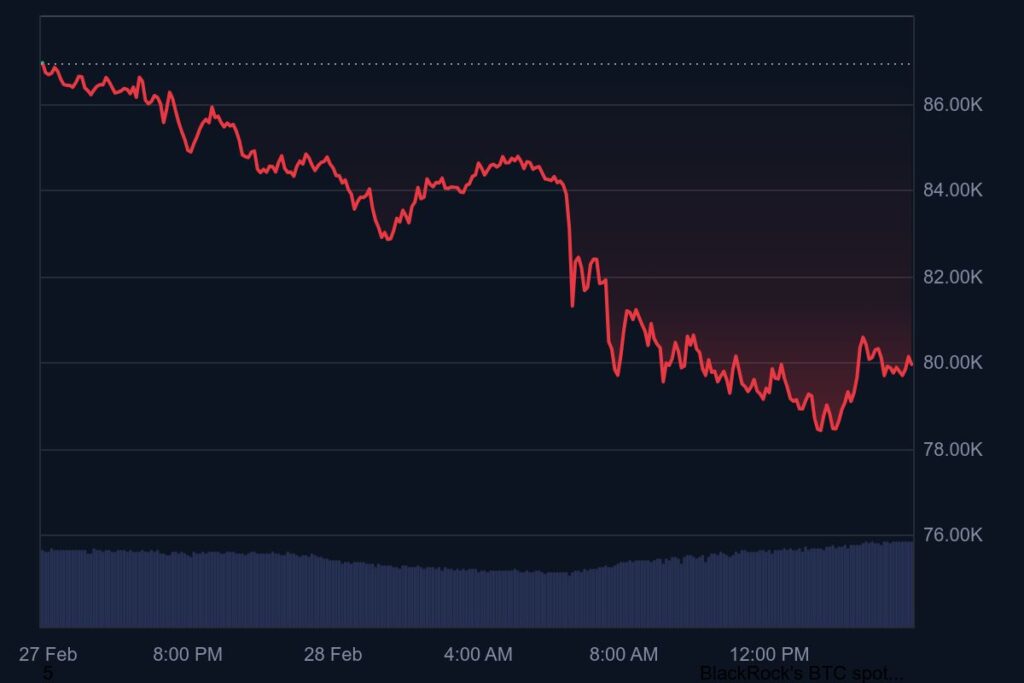

On February 28, Bitcoin trades at $79,808 with an overall decrease of 7.60% taken during the previous day. The cryptocurrency set its daily low at $78,240 and its high at $86,971 today. Bitcoin maintains its leading position in crypto through its $1.57 trillion valuation and makes up almost half of the total market worth. The recent dip in Bitcoin prices leads investors to worry if further downfall will occur when critical support marks do not hold up.

Traders now conduct $56 billion worth of transactions in the market at an accelerated pace. The rising trade volume shows that people with different investment horizons feel the need to respond to price changes by selling or buying.

Technical Analysis: Key Support and Resistance Levels

The price of Bitcoin stays below its several main moving average lines that point to short-term downward market trends. The Relative Strength Index indicates that the market is heading toward an oversold condition at a value of 38. This situation indicates Bitcoin may start bouncing back soon but the market might still fall lower.

Key Support Levels:

- $78,000 – A short-term support level that Bitcoin is currently testing.

- $75,500 – A stronger support zone where buying interest could emerge.

- $70,000 – A major demand zone that could serve as the ultimate support in case of a deeper correction.

Key Resistance Levels:

- $81,500 – The immediate resistance level that Bitcoin must break to reverse its current bearish momentum.

- $85,000 – A crucial resistance point where sellers have previously emerged.

- $88,500 – The recent weekly high, which Bitcoin needs to reclaim to regain a bullish outlook.

Bearish momentum increases according to MACD while the short-term and long-term moving averages prepare for a bearish alignment. A decline from current levels toward the $75,000 to $77,000 band would likely happen if Bitcoin fails to remain above $78,000.

Why Is Bitcoin Dropping Today?

Market Selloff and Profit-Taking

Many investors are selling their Bitcoin assets to secure their recent profits as the market experiences price reduction. Multiple investors across the market sold Bitcoin after achieving their early February profits of nearly $90,000. The market undergoes typical price adjustments following a considerable upward trend that happens during bull markets.

Macroeconomic Uncertainty & U.S. Tariffs

The overall financial market faces uncertainty because rising inflation fears combine with President Trump’s trade tariff plan. Some investors now buy gold as a safe investment during such economic stress and gold prices reached $2,100 per ounce. The cryptocurrency trade volatility makes Bitcoin less appealing for investors hence their belief in this asset has dropped.

Bybit Exchange Security Breach ($1.5 Billion Loss)

Digital asset investors tend to leave the market after Bybit Exchange suffered a record-breaking security breach that resulted in $1.5 billion worth of stolen Ethereum (ETH). The Bitcoin market faces security threats after this event made some people leave digital assets and put money into stablecoins instead. Markets for digital currencies typically react swiftly with brief stock market declines when major exchanges experience security breaches.

Bitcoin Options Market Indicates Further Downside

The Bitcoin markets of Deribit and CME experience heightened demand from traders who want to buy options contracts that predict Bitcoin will drop to $70,000. Market players expect Bitcoin to decline fast through their buying of put options under $75,000.

Bitcoin Price Prediction

The Bitcoin market performance today depends on how well it can recover $80,000 or if selling strength keeps driving down its value. Volatility stays strong so traders need to monitor where buyers and sellers control the market.

Bullish Scenario

The cryptocurrency may head towards $81,500 to $85,000 if it sustains its position above $78,000. A movement above $85,000 in value would confirm new buying momentum and could drive Bitcoin toward $88,500 during the following days.

Bearish Scenario

Once Bitcoin breaks below $80,000 the market may drive prices down to the $75,000 to $77,000 range which matches an important Fibonacci retracement zone. A price close below $75,000 would create buying opportunities for investors at $70,000 because they see the potential to purchase at lower levels.

Expected Bitcoin Price Range for Today

- Best-Case Scenario: Bitcoin rebounds and trades between $81,500 – $85,000.

- Worst-Case Scenario: Bitcoin continues to fall and tests $75,000 – $78,000.

- Most Likely Range: Bitcoin remains volatile between $77,500 – $81,000.

Should You Buy or Wait?

The Bitcoin market holds both potential dangers and investment possibilities at this time. Bitcoin shows negative price movements now, yet its core worth stays steady from a big-picture perspective. When the price reaches $75,000 to $78,000 investors seeking long-term investments should consider entering the market as history reveals it offers favorable buying chances during such periods of decline.

Short-term traders should stay cautious when dealing with Bitcoin. Investors should expect Bitcoin value to decline more unless support ranges stand their ground. Keeping track of market data combined with market mood and technical market readings will help predict Bitcoin’s future direction.