Given that it is notoriously well-known, the Bitcoin community has been ready for the new bull season, which normally follows the halving of April. But as per a CryptoQuant article authored by an analyst called Onchained, that fill up has not yet come and there is a reasonable explanation as to why.

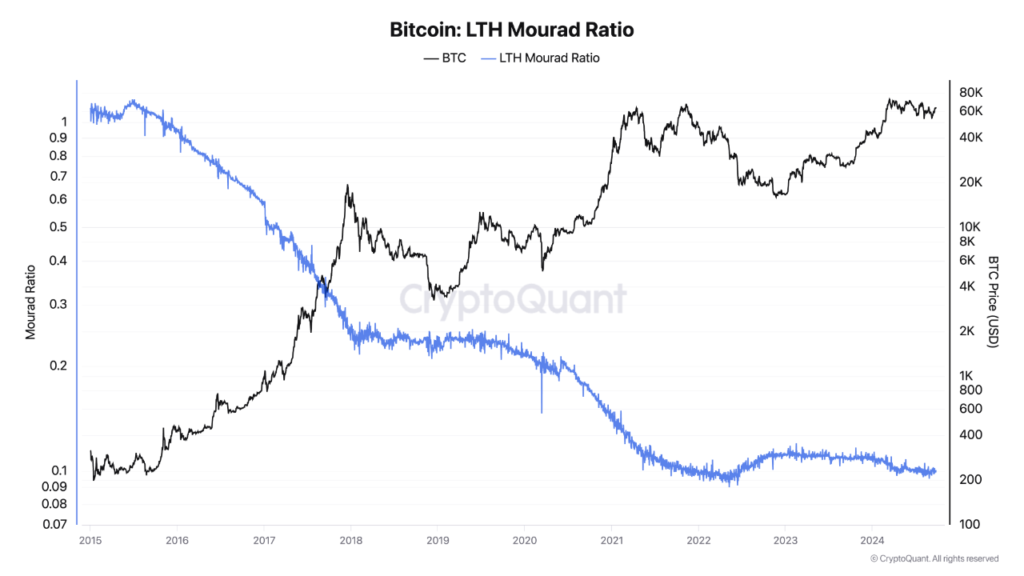

In a recent post on the CryptoQuant QuickTake platform, Onchained’s analysis centers on the Long-Term Holder (LTH) Mourad Ratio which is a proprietary metric that helps measure the unspent transaction outputs (UTXOS) over sixty days.

Bitcoin Holders Await Bullish Conditions

This is useful in determining the market sentiment and the accumulation behaviors of long-term Bitcoin holders. The Mourad LTH ratio analysis is also critical of this stability. Over the years, this ratio has remained stable, it means that the market is not yet ready for any massive escalation in upward movement.

In other words, mainstream investors like Onchained consider that bullish markets occur generally only after the ratio demonstrates a negative deviation from the stable equilibrium. The figures in hand, however, indicate that as of now, the ratio is still unihorminal which means that there is still no bullish run in Bitcoin.

This stability means that the changes today are not enough for long-term holders to affect the price structure in a significant way. Some investors might have to wait for better times before any great surge in prices is hinted.

The Mourad Ratio defines the Long-Term Holder Mourad Current Transaction Value (LTH MCTV) over the change in the current rate of bitcoin and is responsible for the evolution of average UTXO over six months and trends of recent accumulation which are observed.

Onchained insists remains to this prediction of a false bull run clowns, other sell side analysts are looking at historical price charts. As the large news and analytics source the Bitcoin Archive reports that BTC is approaching a “bullish crossover” level on the 5-day chart for the first time in 230 days.

They note in through the history whenever this pattern occurred the prices busted out by 74% and the other 79% which could have pushed Bitcoin beyond the historic past mark of $100,000 if it repeats with time.