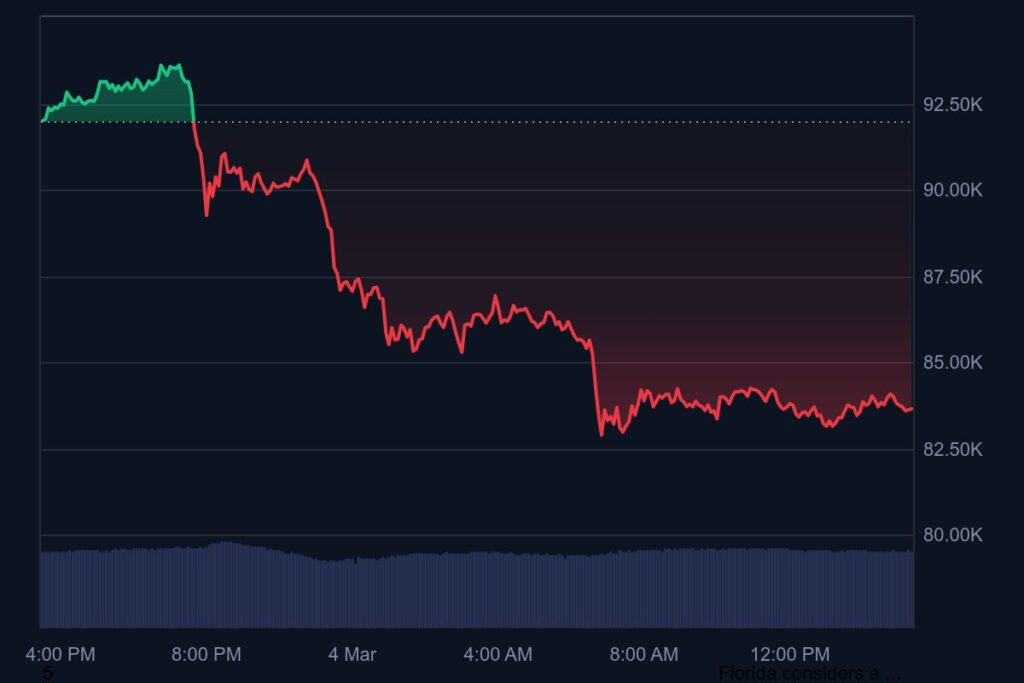

Bitcoin reached $83,711 by March 4, 2025 and showed a decrease of 8.85% against the earlier trading price. The cryptocurrency market experienced strong price swings with trading hitting $93,666 and then sliding to $82,521 during one day.

Bitcoin went down steeply after its previous jump began when President Donald Trump made public the U.S. crypto holdings strategy on March 2, 2025. The news caused a 7.5% price increase that took Bitcoin’s value to $91,572. The market reaction was short-lived because it pushed Bitcoin down from its peak before March 3 to $86,000. BTC traders worry about the current market direction because prices keep lowering.

Technical Indicators and Market Trends

Moving Averages

The latest and longer Simple Moving Average data for Bitcoin stands at $97,699 for the past 50 days and $82,464 for the past 200 days. The short-term market structure shows bearishness when Bitcoin stays below its 50-day Simple Moving Average but takes a bullish shape when prices maintain level above the 200-day SMA. Bitcoin requires a major shift in price direction as it works to stabilize between bull and bear patterns.

Relative Strength Index (RSI)

The Bitcoin market comes under neither buyer nor seller dominance when looking at its 14-day RSI value of 39.19. The Relative Strength Index shows when trading assets become too expensive for buyers or discounted for sellers with values under 30 showing when trading assets are too cheap and those above 70 displaying when trading assets are expensive. The market indicators show Bitcoin neither needs to strengthen nor weaken greatly before taking sharp price actions.

Market Sentiment and Investor Confidence

The Crypto Fear & Greed Index shows extreme fear because its score stands at 15 right now. Market sentiment usually strengthens with low anxiety levels from investors who wait to see how Bitcoin prices will stabilize. During these extreme fear periods, traders tend to find solid investment opportunities, which historically have turned into good entry points.

Market performers experience changes because of the impact of multiple global and political conditions. Due to worldwide economic instability, institutional investors are taking careful steps that increase market fluctuation. The new price drop reflects traders cashing out their profits from the rise after Trump made his announcement.

Bitcoin Price Prediction

The market indicator suggests short-term price growth despite the current decrease. On the basis of detailed analysis, Bitcoin is forecast to reach $91,467 by March 9, 2025 while showing a 9.15% market value hike in the next five days. The forecast depends on past Bitcoin price patterns plus moving average levels as market experts think it will bounce back from its present lows.

When Bitcoin drops below its vital $82,000 support point it starts a significant price decline that likely would move it to $79,000 to $80,000 territory. Bitcoin will seek to reach $90,000 when it recovers to the $86,000-$87,000 area in the upcoming days.

Conclusion

The value of Bitcoin keeps changing strongly because investors wait for more market clarity. Though the Bitcoin price outlook remains positive in the future markets detect warning signs that may drop rates before starting its uptrend again. Investors need to watch the market price structure for trading entry signals but long-term buyers may see this downfall as a way to add Bitcoin to their portfolios at cheaper prices.

Investors in cryptocurrency markets need to remain cautious and analyze both trading signals and national economic conditions for their investments.