Among other things, the price of the cryptocurrency has been encouraging because the traders are expecting a bull market. Over the week, its value surged to a one-month high of $4,400 – a close of a very eventful week.

After the crashing of $64,700, the BTC/USD price breathed a sigh of relief but remained stagnant around end-of-week closing figure. The popular trader noted optimism in binance’s order book as the limit bids were stated as increasing which is in support of price.

Bitcoin RSI Shows Breakout

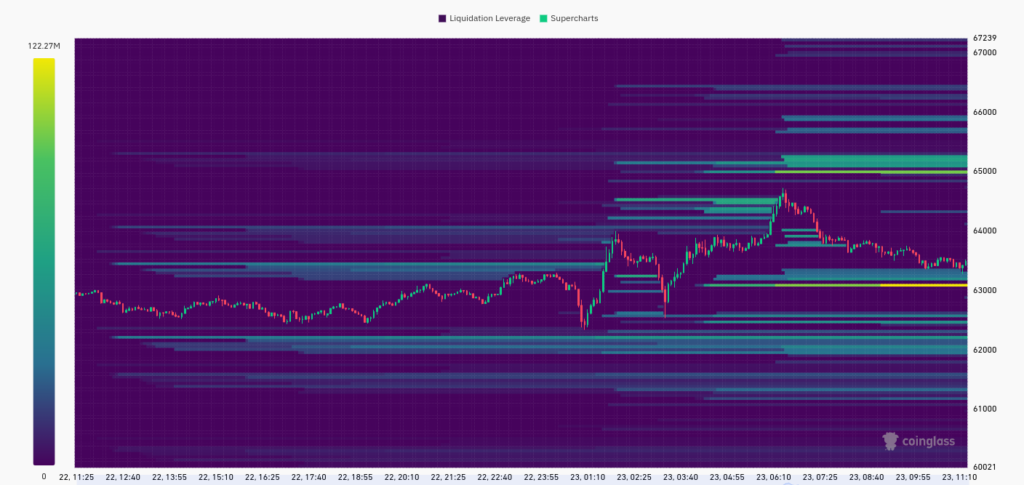

The $65,000 level has continued to present resistance if ever breached. Liquidity is at $63,000 and $65,000 fellow trader Jelle adds that the present trend is like that of September 2023 in that there are higher lows. RSI remains one of the most essential contributors of BTC mid term outlooks.

Weekly RSI graphs also show a potential breakout with the RSI fluctuating above the level of 50. This rapidly changes with Analyst Titan of Crypto having a BTC price target of 85000.00. Kevin Svenson has asserted that BTC market will see active moves all the way until 2025 and spike the RSI breakout lift as a strong bullish sign in the history of Bitcoin.

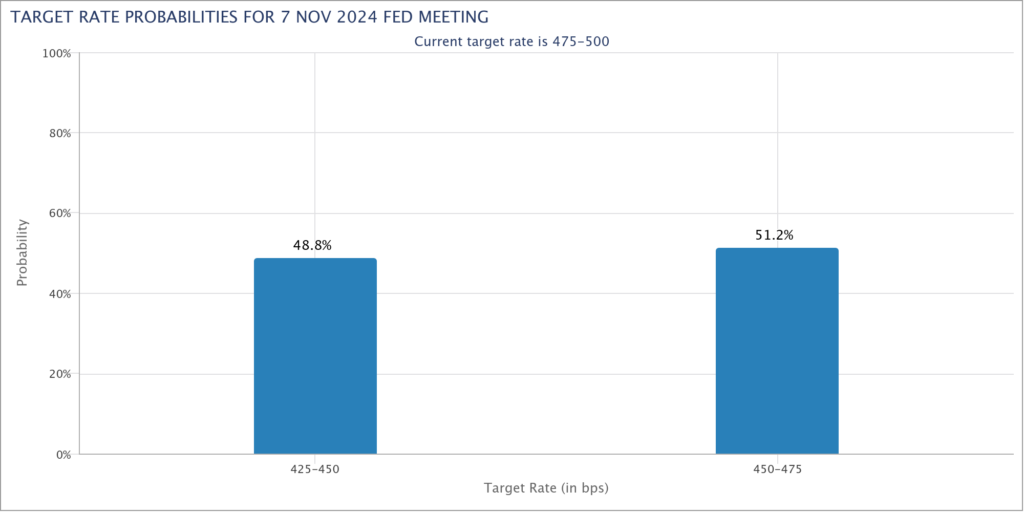

In addition, external events should be considered, as it comes after the surprising (to many) cut of 0.5% in the interest rate by the U.S. Federal Reserve on September 18’. The news did not only create 6% gain of Bitcoin against the US dollar but also shifted the sentiment of the markets in anticipation of even greater cuts by the end of the year.

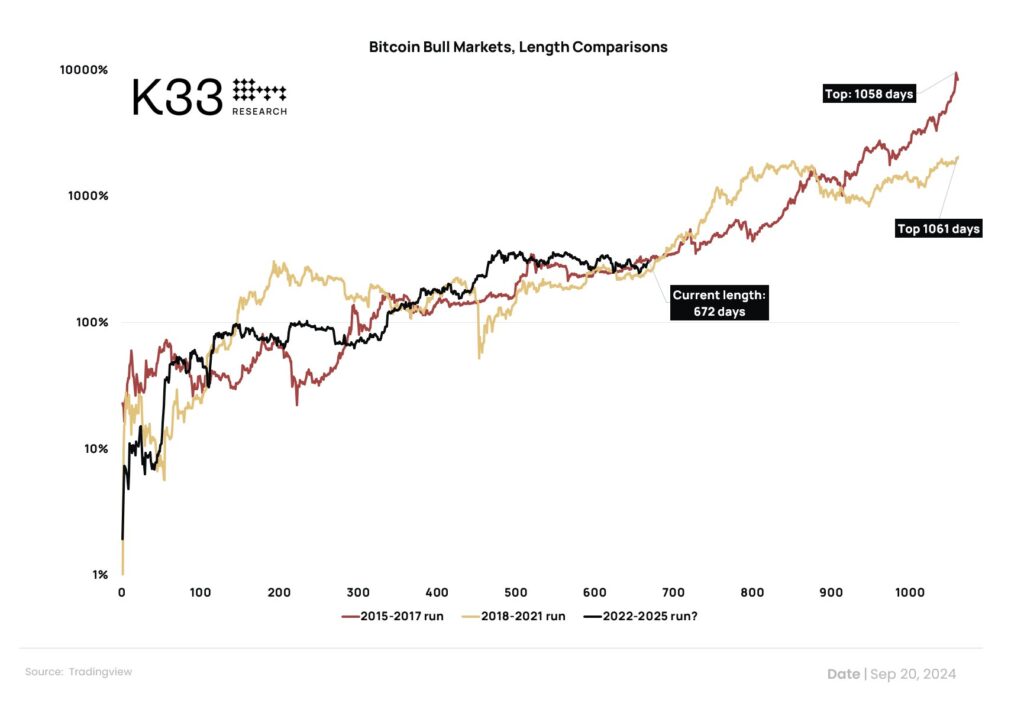

“The past two bull market cycles from trough to peak lasted for +1050 days, with the final 365 days seeing the greatest gains. The current 672-day trough-to-peak performance sits right in the middle of past cycles. Will it repeat?”

The stock markets have also risen sharply as indices show that of the S$P 500. Mosaic Asset also provided in particular its newsletter has mentioned that the decrease in rates should help in increasing the GDP and the company profits.

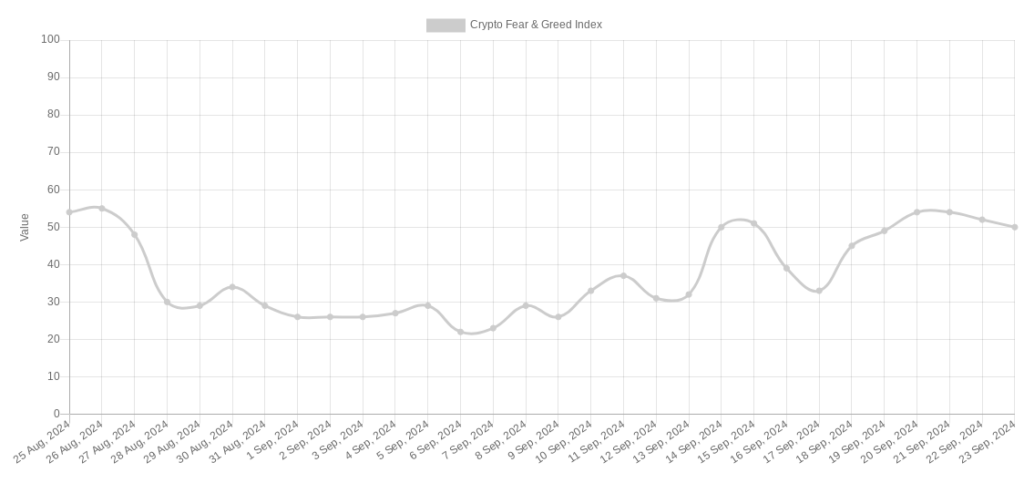

This week is going to be make or break for BTC and other markets with key economic data releases from U.S such as the inflation figures and GDP. Bitcoin managed to gain additional value over the last few days, however, according to the Crypto Fear & Greed index a reasonable active film Pitch modular rational model default is maintained at 50/100.

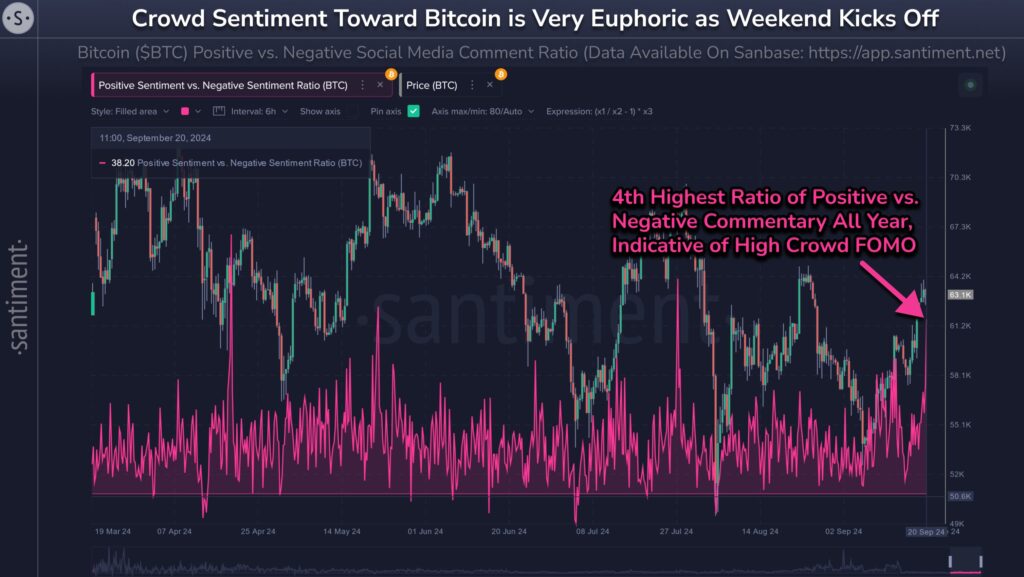

K33 Research historical insights note that based on typical bull market structure BTC seems to be entering into after almost 700 days since Bitcoin bear low of 2022. At the same time social media analysis provides caution that there may be a potential FOMO as bullish sentiment is building after the Fed cut rates.