The short-lived Bitcoin climb to $90,000 happened because market risk factors and reduced institutional funding affected its price movement. At first Bitcoin regained strength by increasing 10% on March 2 until it broke past $95,000. After reaching $94,200 the market created a specific bearish chart pattern which led to a quick decline.

The charts on TradingView show Bitcoin reaching its lowest point at $81,400 after the crash and later facing problems staying above $90,000. Bitcoin shows strong volatility because analysts blame both U.S. spot Bitcoin ETF outflows and weak economic conditions.

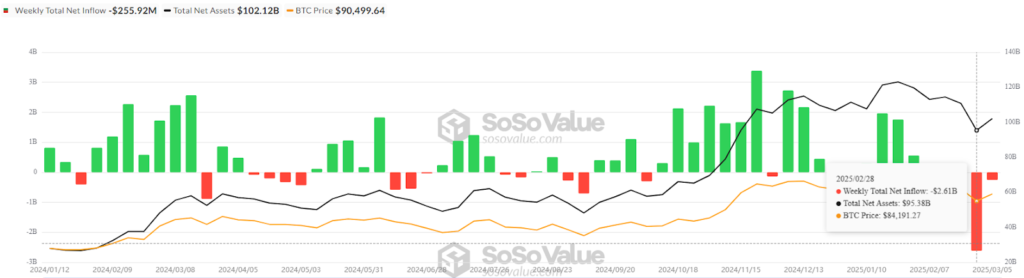

In his analysis Ryan Lee reports that US spot Bitcoin ETFs lost their investment value over four straight weeks. The Sosovalue financial database shows $2.6 billion worth of cash left U.S. spot BTC ETFs during February’s final week which demonstrates investors changed their opinions about BTC price movement.

Bitcoin ETFs Face Heavy Outflows

The BTC market price continues to drop because of developments in macroeconomics. The US tariffs and their effects on global markets create uncertainty that pushes down the prices of digital assets and stocks. Nexo dispatch analyst Iliya Kalchev explains that trade policies between nations prevent markets from showing long-term optimism. He believes upcoming news on policy matters will alleviate market worries.

Bank Rate expectations of Federal Reserve participants directly impact BTC price trends. According to Kalchev the market may see better crypto conditions due to more rate cut prospects.

Based on their evaluations analysts foresee strong growth for Bitcoin’s value through the end of 2025. The estimated price window runs from $160,000 to $180,000 because investors believe this digital asset will thrive over time as monetary policy advances digital currencies.

Despite cryptocurrency market problems the Bybit hack continues to cause issues because it bankrupted investors for over $1.4 billion on February 21. The attack added more risk to crypto investors which makes them choose to wait and see. Market participants monitor BTC developments through ETF activities and economic and institutional trends to predict its upcoming market shift.