Strong cryptocurrency trading pushed Coinbase and Robinhood to greater than expected fourth-quarter results that led stock analysts to boost their market predictions. Coinbase achieved a year-high performance in its latest earnings results due to heightened trading activities which occurred after Donald Trump successfully won his second presidential term.

Robinhood’s main stock trading services brought 700% higher crypto revenue results compared to a year ago and topped market predictions. JPMorgan analysts predict 2024 as a turning point for crypto markets because citizens, policies, and trading habits are growing faster than expected.

Coinbase Reports Strong Growth

The market shows more stability as Trump supports cryptocurrency and selects pro-industry regulators. Over the last year Coinbase and Robinhood stock rose 112% and 365%. After observing their latest results JPMorgan and US Tiger Securities boosted their Coinbase stock price predictions to $344 and $300 per share respectively from $264 and $265 formerly.

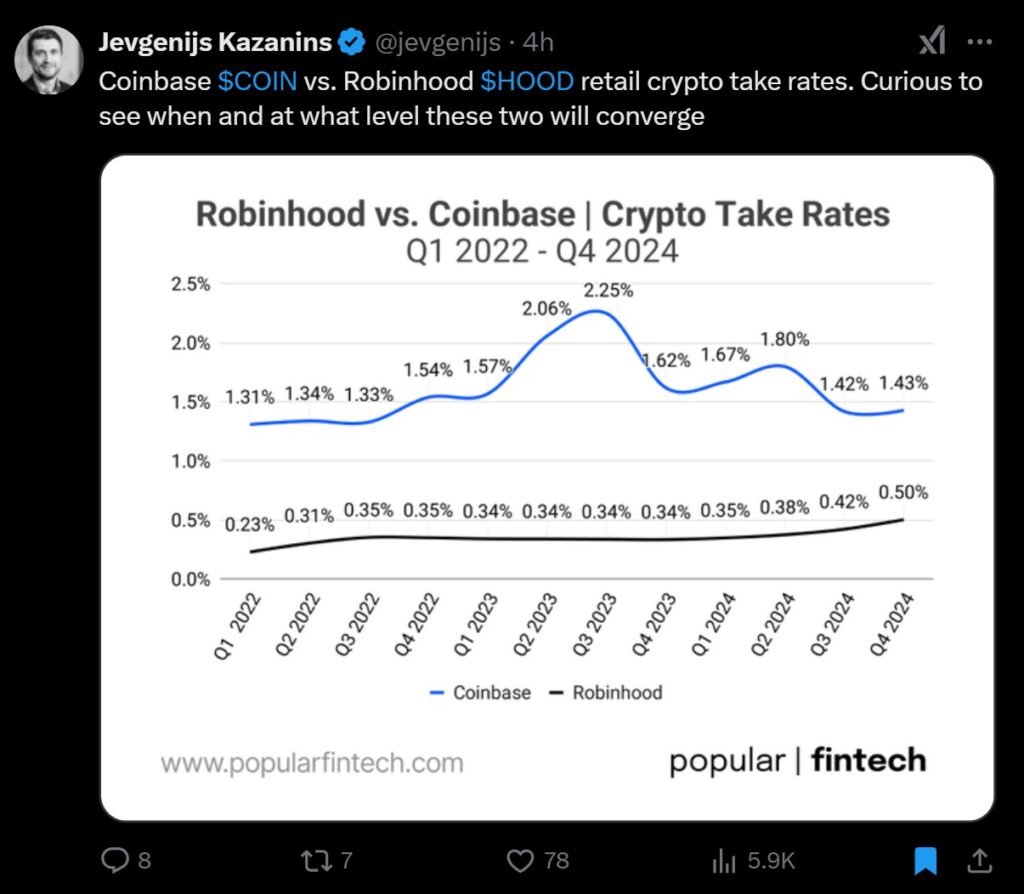

By revealing its Q4 statistics Coinbase showed $2.3 billion in total sales which increased 88% from prior results and generated $1.3 billion in net income. Pros and institutions submitted $94 billion and $345 billion worth of transactions during the reporting period.

Coinbase earns money from various sources beyond trading that include protecting customer assets and handling stablecoins on behalf of its users. JPMorgan adjusted its Robinhood (HOOD) price forecast to $45 because the company relies more on crypto revenue generation.

The firm earned $358 million from cryptocurrency transactions which made up 35% of its total revenue during this period its highest ever performance. The research community forecasts rising earnings for Robinhood because they plan to increase crypto tokens on their platform and complete their purchase of Bitstamp.

CME Group hracks trading records with its Q4 crypto performance and prepares multiple digital currency product releases for 2025. Exchanges involved in the crypto market now stand strong from new government rules and institutional support that makes them better performers.