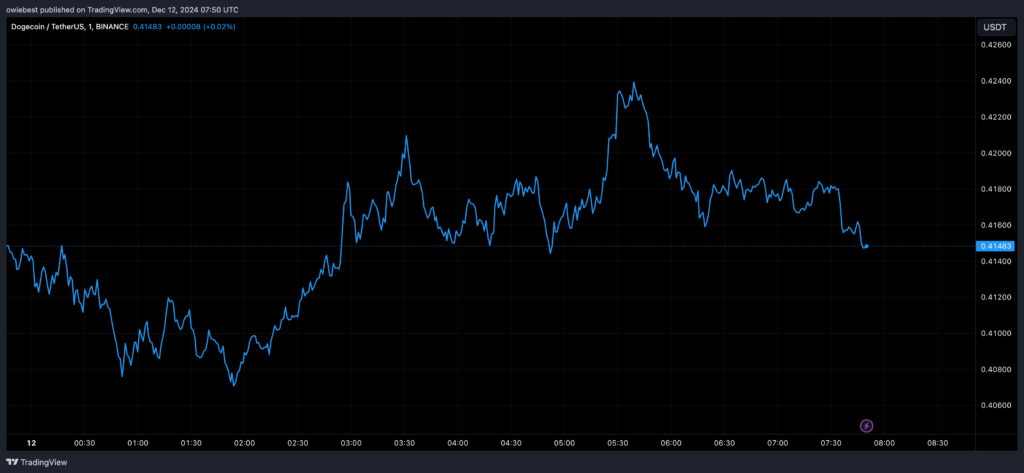

While the journey to $1 for Dogecoin continues to be a crypto community talking point, analysts stressed that $0.48 needs to be overcome first. TradingView: A report on which points may determine if the current bull cycle is make or break.

Dogecoin was rallying recently but keeps failing to push past $0.48 — notable rejections hit a dime piece at $0.475 on November 23 and December 8. Bullish momentum can be seen in the current price of $0.42, up 7% in the last 24 hours, however the challenges ahead will be as much as the price received.

Dogecoin Bounces Off 200-Day EMA As Key Support

As Dogecoin has bounced solidly off the 200 day exponential moving average (EMA) during the 4 hour chart the 200 day EMA on the 4 hour chart has emerged as a key support level and suggests strong buying interest and resistance to downward pressure. According to analysts, all these confluence of support and bullish sentiment brought us another opportunity to challenge $0.48.

But people are still resistant at $0.48 and it’s a liquidity zone of resistance where Dogecoin sells aggressively. Still, analysts predict that should the price fail to break through this level, it could see a greater pullback to the $0.20-$0.24 range. Despite discouraging for short term investors, this setup could lead into a stronger rebound.

Long term investors may find a dip into the $0.20 area as an attractive opportunity to buy, as the forecast indicates that the price could break through $0.48, reaching the elusive $1 target.

Even so, there’s an optimistic longer term outlook. Dogecoin’s continued ability to hold key support levels and consolidate during pull backs, will be key for continuing the bullish trajectory, say analysts. While uncertain, the only way to reach $1 is through those all important price levels in the coming weeks.