The market’s eyes have returned to back above $3,500 in July 2024, the price of Ethereum’s resurgence. Renewed optimism seen as analysts warn turbulence ahead as altcoin leader simultaneously pumps by 8 percent weekly as key onchain metrics send mixed signals.

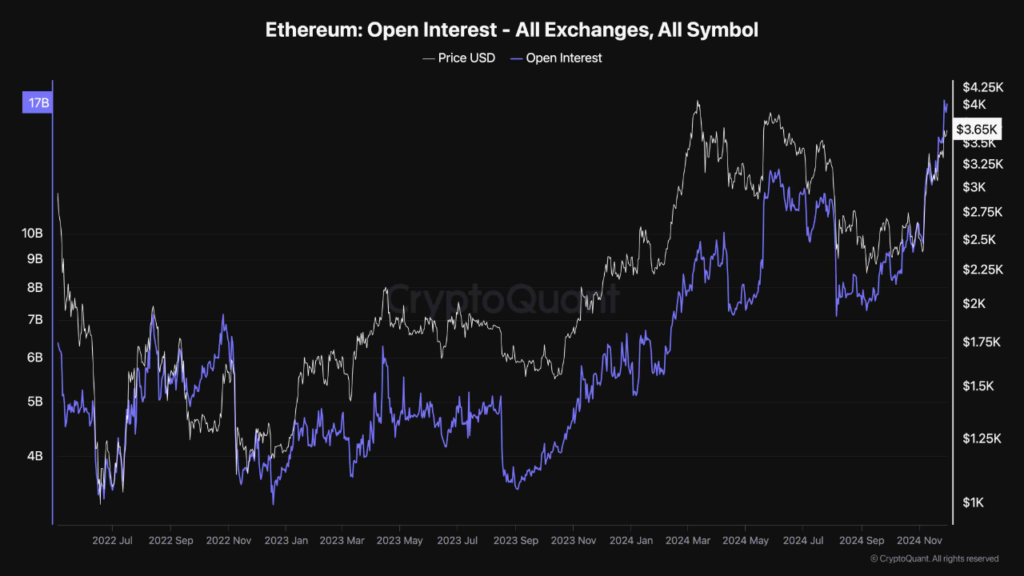

One standout indicator drew attention of CryptoQuant: Open interest on Ethereum hit a record $17 billion. By open interest we know how much speculation ther is in the market for each and every contract. This surge of traders’ engagement often occurs before large price move and indicates that.

Ethereum Gains 3 Percent

This has been joined, however, by a divergence between the price and open interest of Ethereum. The rise in open interest suggests increased volatility however the price hasn’t matched the all time high. CryptoQuant ShayanBTC highlighted that after sharp price swings, there may be liquidation cascades.

The day has added 3 percent to ethereum’s value, now trading at over $3,700 apiece. While this is bullish momentum, this rally isn’t sustainable. In the past small increases in openinterest from terramycin over the counter have resulted in market corrections without the accompanying increases in price.

Both whales and the large investors are being more confident than fearful. Crypto analyst Ali Martinez spotted that there is 280,000 ETH being deposited by prominent Ethereum wallets with amounts between 100k and 1m ETH in 4 days. This sort of monumental buying normally tames the prices, so that hedges the strength of the underlying market.

Ethereum is torn between skyrocketing open interest and a collection of whales. If this last trend hums on, volatility risks can be pared back and more price gains should be hit. In this sense, sharp corrections can occur with speculative overextension.

Market watchers will watch as ETH accumulation bulls play against liquidation risks. ETH’s rally yet remains a spectacle of optimism tempered, but for now.