GameStop’s stock price increased sharply on Monday because of its CEO Ryan Cohen’s mysterious network post which suggested possible Bitcoin-related enhancements for his retail business.

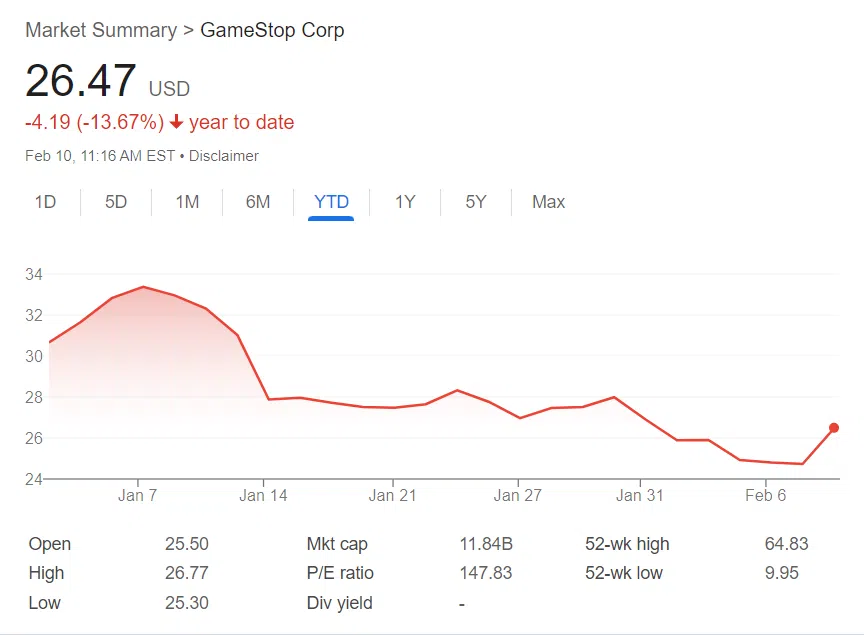

GameStop (GME) stock gained 7% during opening minutes when Cohen posted on X (Twitter) next to Michael Saylor. On press time Google Finance data shows GME shares at $26.39 and their current price has gone up by 6.7%.

Cohen shared his social media post without context and this created intense guessing among investors who track Bitcoin and cryptocurrency markets. Some investors think GameStop may enter the Bitcoin market since Strategy keeps attracting interest with its powerful Bitcoin purchasing strategy. Cohen remains quiet about his meeting details since GameStop keeps official Bitcoin or cryptocurrency mentions absent from its releases.

GameStop Struggles to Regain Investor Confidence in 2025

As GameStop builds back investor trust it aims to reshape its business plan through this recent share price increase. Online investors on WallStreetBets platform drove GameStop’s shares up through their buying activity triggering losses for hedge funds who had bet against the company in 2021. Melvin Capital suffered big losses amounting to $7 billion from its short trades against GameStop.

GameStop failed to resolve its significant problems in 2025 despite achieving a short-term success on Monday. During 2025 traders caused GME stock prices to decrease 14% since they expect significant changes yet have not occurred. GameStop aims to shift from retail video game stores but investors see limited potential in their new strategy.

Players will watch how GameStop proceeds with Bitcoin ventures when new announcements emerge. Launching cryptocurrency services will provide GameStop a new path to succeed and could attract back its investors.

Market participants wait to learn what results Cohen’s talk will produce with Saylor. Everyone needs to watch future developments that show if the current stock movement with meme stocks lets GameStop keep making money in the long-term.