PEPE Coin attracted market attention because its price moved sharply in recent days. On February 25, 2025, PEPE trades at $0.000010 after rising 3.43% but falls 21.91% short of its $0.000012 target price. Even though Pepe Coin increased in value today, its actual price remains 21.91% below its predicted target of $0.000012. This research investigates PEPE price market actions and its price changes. The model shows how rates will change over time based on present market data.

PEPE Price Performance and Market Data

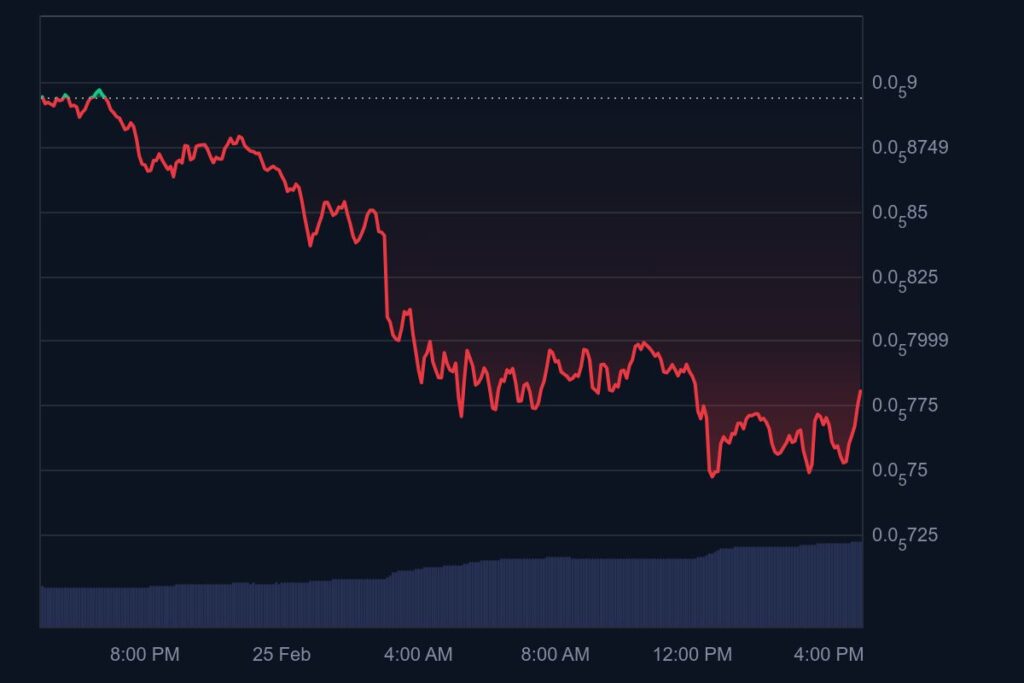

PEPE now has a $4.5 billion market value and a trading volume reaching $1.2 billion every day. The token continues to experience healthy amounts of transactions on the market. After its $0.000028 price peak on December 9, 2024 PEPE has shown a steady price reduction.

The PEPE market value declined 40.05% during the last month because investors sold profusely while markets fell in value. During the previous year PEPE generated an exceptional 767.08% growth which positions it among the most successful meme coins.

Technical Analysis: Will PEPE Move Higher Today?

Support and Resistance Levels

Now PEPE attempts to exceed its resistance barrier at $0.000010. PEPE may advance towards $0.0000105 and potentially $0.000012 when it passes above its resistance at $0.000010. The price of PEPE will likely drop back to $0.000009 when its current momentum weakens and may keep falling to $0.0000085 under increased bearish selling pressure.

Key Technical Indicators

PEPE currently shows neutral market conditions since its Relative Strength Index measures 36.33 and sits near the bottom of the scale. A balanced market mood exists but buyer support can switch market movement from down to up.

The PEPE price movement shows bearish trends over 50 days and 200 days because both Simple Moving Averages indicate sellers are in control. The moving average convergence divergence indicator points down when its lines separate indicating further market declines unless investors kick in strong buying pressure.

At the bottom of its trading range PEPE shows signs of an upcoming price increase. The current market direction stays negative until PEPE breaks through the midpoint channel.

On-Chain and Market Sentiment Analysis

Whale and Retail Investor Activity

The flow of investment from big PEPE owners currently shows decreased activity. These current actions suggest the whales will observe ongoing market movements first. Small investors continue to trade PEPE but their interest falls below what they purchased last month.

Social Media and Sentiment Analysis

People still focus on PEPE meme coin discussions across X and Reddit while traders predict its future recovery. Investors are undecided about market trends because they need confirmed instructions from the market.

Overall Market Trends and External Factors

The broader crypto market, especially Bitcoin’s performance, plays a crucial role in PEPE’s price movements. A Bitcoin trading level above $50,000 provides a helpful setting for PEPE and other meme coins to make their comeback. Crypto market downturns would likely lead investors to sell PEPE tokens in large numbers.

PEPE Price Prediction for February 25

Whether PEPE succeeds today against resistance determines its price outcome. When PEPE pushes past $0.0000105 in its next major resistance level it might reach $0.000012 before closing the market today. A decline to $0.000009 might occur when the crypto fails to maintain its position above $0.0000105.

Possible Scenarios for Today:

- Bullish Case: If PEPE breaks above $0.0000105, it could surge to $0.000012 within the next few hours.

- Neutral Case: PEPE consolidates between $0.0000098 and $0.0000105, showing limited movement.

- Bearish Case: A failure to hold support could push PEPE down to $0.000009 before a potential recovery.

Final Thoughts: Is PEPE a Buy Today?

Traders should approach PEPE buying decisions based on their appetite for market risks and their outlook on the market. You should consider buying right now when buying meme coins because they show growth in the future despite their unpredictable price movements. Technical market signals show a downward trend yet you should watch for the asset to break through resistance levels before investing.

PEPE presents buying risks because its current market position shows weak performance. Traders need to analyze important resistance and support points before they take action in the market.