The signs that Solana’s price may fall further show up in its upcoming death cross pattern linked to DEX service drops across all measurements. Since November 6 the SOL token experienced its biggest drop when it hit $159 and reduced by 46% in value from its February high.

Solana’s value drops because its ecosystem faces multiple problems mainly in the world of meme coins. SD-based meme coin financial value dropped from $25 billion to $9.8 billion between January and February. Several popular tokens such as Dogwifhat, Official Trump, and Pudgy Penguins lost major value and dropped billions in market capitalization. People lost faith in the market and decreased their trades which made Solana tokens harder to sell.

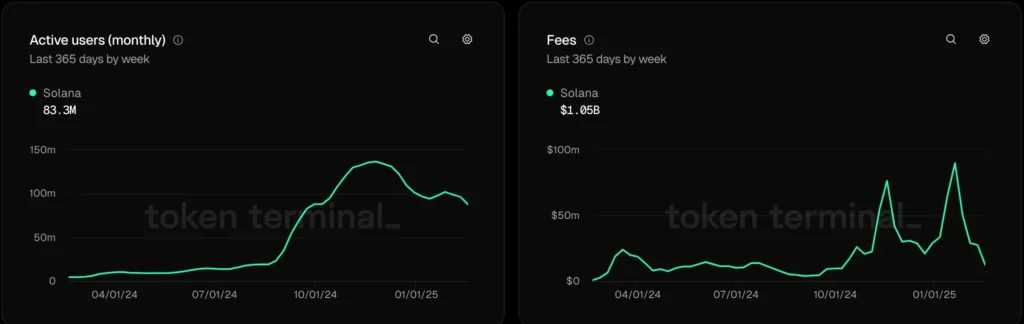

When we examine Solana’s inner values it matches what happened in the overall market situation. TokenTerminal data reveals a major decrease to 87.3 million active users on February 14 as they registered their lowest numbers since Oct. 7. Investors have departed from Solana’s network to other systems or left crypto investments across all platforms.

Solana Revenue Falls Sharply

Earning levels dropped under $1 million daily. During Feb.14, SOL earned $978,000 in revenue but later decreased yearly from a peak amount of $44 million. Fewer online network transactions can weaken Solana’s long-term future unless usage numbers improve.

The entire decentralized exchange market struggles due to falling meme coin values. The money flowing through Solana at crypto trading platforms decreased by 36% bringing their weekly trading volume down to $16.7 billion. They now rank below Ethereum at $18.3 billion and Binance Smart Chain at $16.9 billion. The lower DeFi trading on SOL will slow network innovation and development in the future.

Since Jan.19, SOL has been in a strong downward trend following its $295.28 price peak. The price showed a double top formation at $263 with $169 as its lowest point from Jan.13. The current dip below the $169 neckline shows that traders expect SOL to keep losing value and provides evidence the price could decline further next.

Solana Faces Uncertain Future

Solana shows a death cross pattern as its 50-day Weighted Moving Average. orientation falls under the 200-day Weighted Moving Average. The Percentage Price Oscillator has started to drop which brings more reason to expect market changes. SOL struggles to reverse trends due to combined market bearishness which needs strong market drivers to succeed.

Market observers foresee SOL prices falling ahead because of platforms’ problems and basic market conditions. Investors should watch for $110 as their next support target because this area reached a bottom in August 2023 and presents a possible drop of 30%.

The bearish plans for SOL require buyers to push prices past $200 to become effective again. People watching the market will observe price actions and fundamental changes to forecast Solana’s future direction throughout this downturn.

The direction of Solana’s market performance relies on larger cryptocurrency market growth alongside investor confidence and advancements throughout the Solana platform. Changes to institutions active in SOL , technical engineering work, and official guidelines will determine how things go for SOL in the future. Market participants should exercise care while watching important price levels and market signs to handle recent market instability.