Stablecoins and cryptocurrencies are increasingly displacing fiat currencies in Eastern Asia, with Hong Kong leading the region in crypto adoption.

A recent Chainalysis report indicates that Eastern Asia accounted for over 8.9% of global cryptocurrency value received from June 2023 to July 2024, making it the sixth-largest crypto economy. Notably, 40% of the region’s crypto transactions involved stablecoins.

The rise in crypto adoption is particularly pronounced in countries facing fiat currency devaluation and high inflation, according to Maruf Yusupov, co-founder of the gold-backed digital stablecoin Deenar.

Stablecoin Reduces Remittance Costs

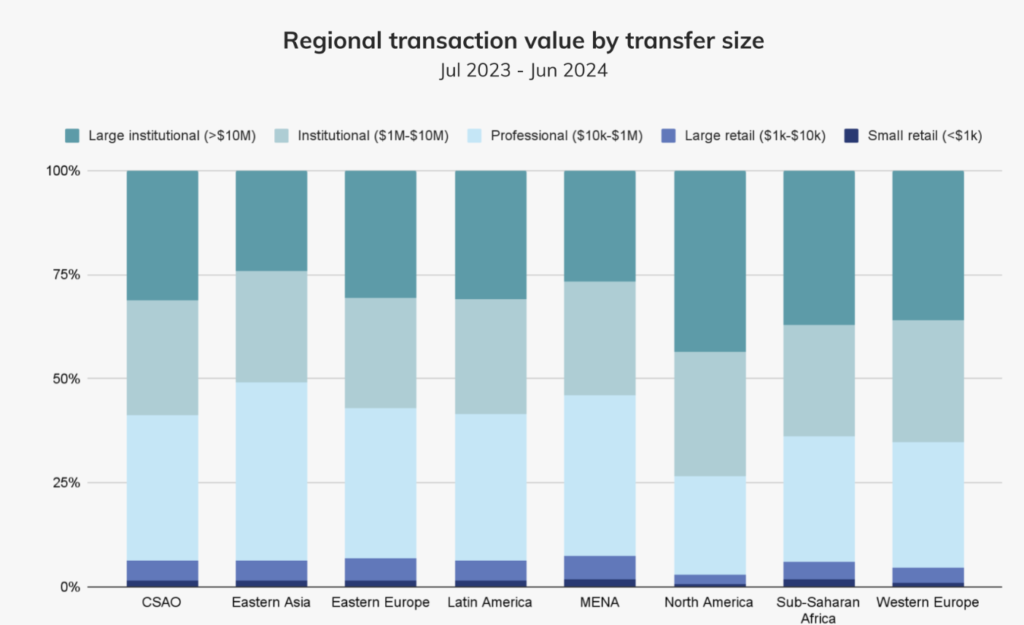

He noted that cryptocurrencies offer a more cost-effective and efficient alternative for cross-border transactions, which often incur high remittance fees averaging 7.34% for bank transfers, as reported by Statista. During the specified period, Eastern Asia received over $400 billion in on-chain value, primarily driven by institutional and professional investors.

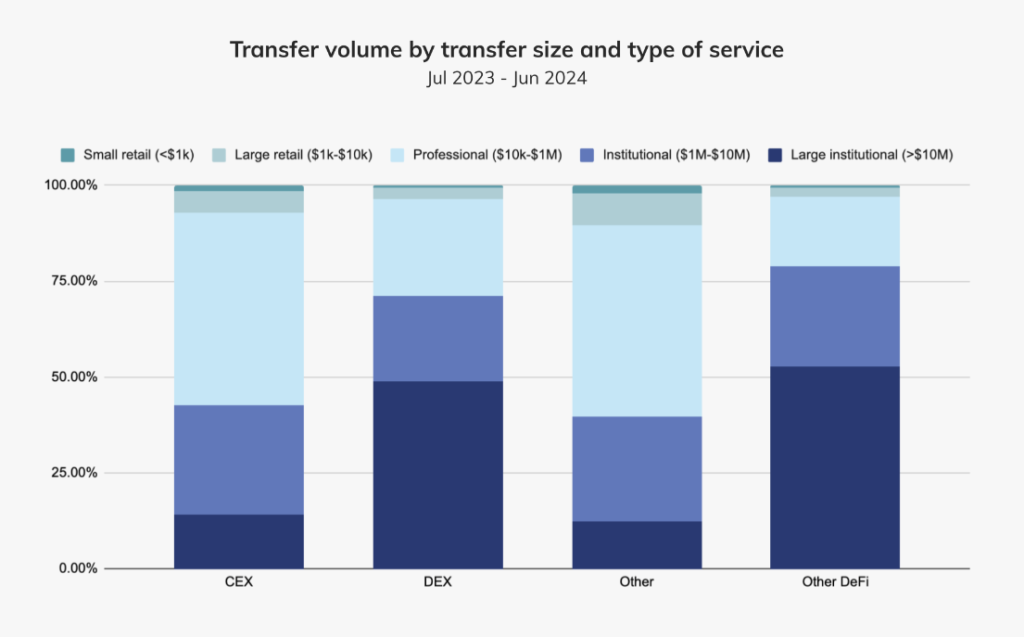

The Chainalysis report highlighted that institutional activity is marked by large digital asset transfers, with decentralized exchanges (DEXs) being favored for their arbitrage opportunities, while centralized exchanges (CEXs) remain popular among professional traders.

Hong Kong’s ambitions to become a global cryptocurrency hub appear to be materializing, with a remarkable 85.6% increase in crypto adoption year-over-year. This growth is significantly bolstered by stablecoins, which represent more than 40% of the total value received in the region.

However, increased cryptocurrencies usage may lead to heightened regulatory scrutiny. Yusupov pointed to recent developments, including Hong Kong’s July 2024 proposal for a new licensing regime for fiat-backed stablecoin issuers, as a potential catalyst for more comprehensive regulation in the sector.