UNI serves as the main token for Uniswap Decentralized Exchange (DEX) but its market valuations shift while investors face market risks. Our analysis covers present market prices combined with technical signals and trader emotions that may guide UNI’s next trading phase.

Current Market Data for Uniswap (UNI)

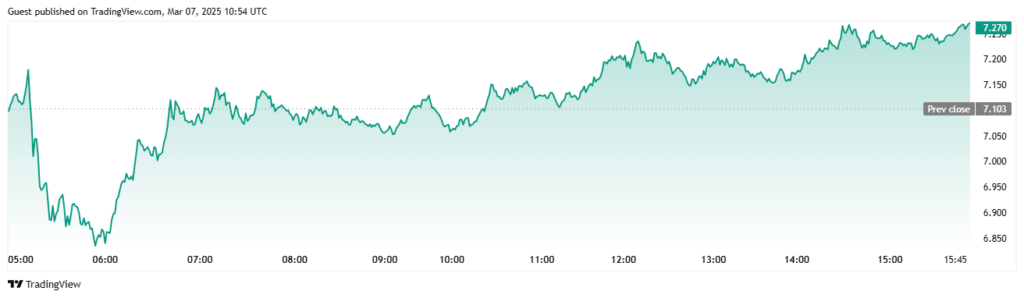

Uniswap’s value reached $7.24 at March 7th 2025 and dropped by 0.23% during the previous 24 hours. During one trading day UNI experienced price changes from $7.54 at its peak down to $6.81 at its low point. This indicates significant movement in market prices.

The total market value of Uniswap at $5.47 billion shows increasing trading volume of $194 million throughout one day. Investor activity remains at a medium level but shows a negative attitude because prices continue to drop in this market trend. Out of all UNI tokens currently in use, the market features 762 million which keeps the network steady.

Technical Analysis

Moving Averages (MA) Indicate Bearish Momentum

The token’s price floats below important moving averages which shows market players expect prices to decline further. Over the past 50 days UNI has averaged prices around $10.21 while its 200-day moving average lies at $10.09. Downward market strength shows strongly in UNI since it trades below both Simple Moving Average levels.

UNI shows a bearish trend because the 10-day Exponential Moving Average stays at $7.42 and positions above the asset’s current price. The market may begin recovering from its lows when the security breaks through the 10-day Simple Moving Average.

RSI Suggests UNI is Approaching Oversold Territory

The Relative Strength Index shows UNI at 38.71 which marks a neutral point but reveals it is nearing oversold market levels. Wholesale buying opportunities in UNI may come when its Relative Strength Index moves below 30. The market needs to fall more before reaching a possible turning point despite RSI staying above its warning level.

MACD Confirms Bearish Sentiment

The Moving Average Convergence Divergence indicator signals that selling pressure will probably remain strong. The MACD line stays below the signal line as negative momentum appears in the MACD chart. The strong selling force in crypto markets needs substantial market attitude improvements to change direction.

Support and Resistance Levels

The present market test of essential prices will shape UNI’s direction for the upcoming weeks. For the past days $6.80 has served as the primary support level to stop UNI from falling. The stock of UNI will probably drop below $6.50 if the support level at $6.80 breaks.

The next resistance stand at $7.50 represents the initial obstacle for UNI price growth. The market will likely rally when UNI moves past $7.50 with active buying interest and heads toward $8.00.

Market Sentiment and Investor Outlook

Investors reflect extensive fear in the Uniswap market because the Fear & Greed Index shows a score of 25 at present. When the Fear & Greed Index shows weak investor confidence it tells us that traders want to stay away from the market because of unknown factors and investment loss possibilities.

People who invest for years ahead view UNI prices as buying chances yet day-traders stay cautious about market risks. Major players in the crypto market have bought more UNI tokens at lower costs and plan to keep purchasing because they see great success ahead.

Crypto Analyst Ali Martinez Price Prediction

The chart in Ali’s post demonstrates that 5.2 million UNI tokens moved from wallets to exchanges within two weeks, which suggests traders may have increased their selling activity in the crypto space.

Recent market analysis notes that Uniswap’s platform partnership with Robinhood plus MoonPay and Transak could modify UNI market conditions.

The cryptocurrency market now stands at $2.66 trillion and shows upward momentum but also results in UNI losing value because many users moved their tokens as stated in the post.

Uniswap (UNI) Price Prediction

Based on technical indicators and market sentiment, Uniswap’s price could move in three possible directions today:

- Bullish Scenario: If UNI breaks above the $7.50 resistance level, it could climb towards $7.80–$8.00 by the end of the day.

- Bearish Scenario: If UNI fails to hold above $6.80, it may decline to $6.50 or lower, continuing the bearish trend.

- Neutral Scenario: If trading volume remains low, UNI may consolidate between $7.00 and $7.50 with no major price movements.

Short-Term Price Forecast

Looking beyond today, short-term forecasts suggest slight fluctuations in UNI’s price:

- In five days, UNI is expected to trade around $7.89, reflecting a 9% potential increase.

- In one month, the price is projected to reach $7.68, showing a 5% rise.

- In three months, the price may hover around $7.30, suggesting a period of consolidation with minor growth.

These projections indicate that while UNI may see small recoveries, significant bullish momentum is unlikely unless market conditions improve.

Should You Buy UNI Today?

Investors wanting to use Uniswap should base their choice on their trading approach and willingness to accept risks. Short-term traders need to observe how UNI breaks through $7.50 to proceed with their investment. A successful rise above $7.50 will produce significant stock movement swiftly. Long-term investors see UNI at its current price level as inviting for regular purchasing, especially when it continues declining into an overvalued condition.

We need to view these conditions within the context of the entire market. The cryptocurrency market’s continued downward trend puts barriers in the way of UNI’s price increase.

Final Thoughts

The price of Uniswap now hits resistance at $7.50 and shows support as low as $6.80. Technical research shows UNI will stay in a downward phase until the price crosses resistance barriers before starting up. Investors act with high concern since market mood stays guarded.

Investors need to watch both support and resistance lines plus trading volume together with market direction before taking action in this market. Even though UNI looks promising over the long run, its short-term market dangers continue to threaten investors.