Asset management firm VanEck sees a bullish forecast for the cryptocurrency market in 2025, thinking that the market will post significant gains in Bitcoin (BTC) and other major digital assets by year end. But a big market correction is coming in the first quarter before there is a rally again, the firm warned.

In a December 13 blog post, head of VanEck’s digital asset research Matthew Sigel projected Bitcoin could hit $180,000 in 2025 and Ethereum (ETH) would exceed $6,000, according to Coindesk. Other major altcoins such as Solana (SOL) and Sui (SUI) are expected to go up to $500 and $10, respectively.

VanEck Anticipates Market Pullback Before Crypto Highs

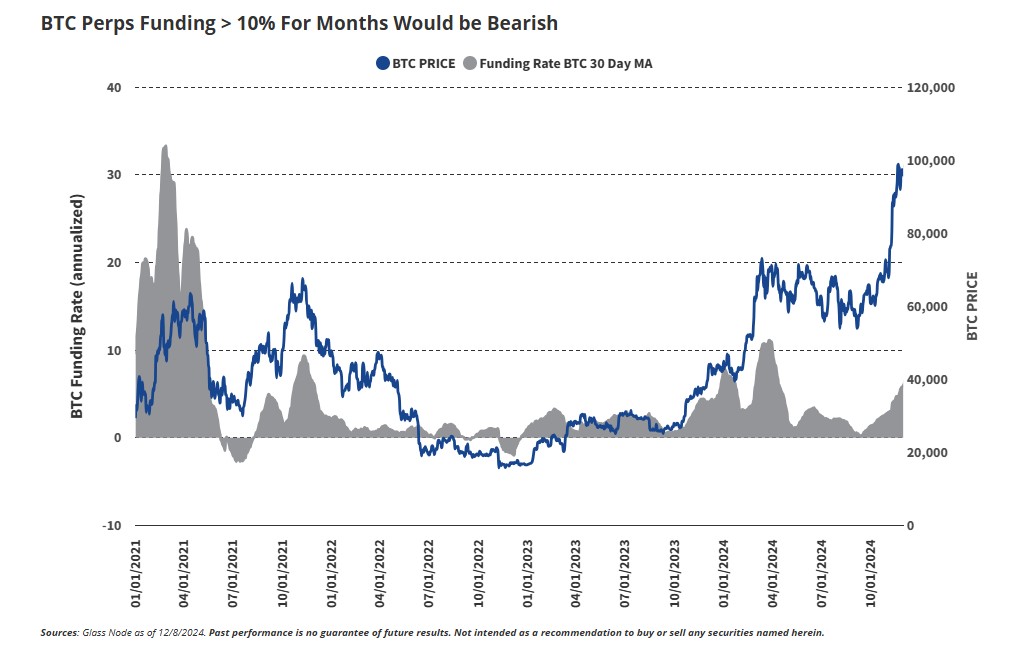

VanEck predicts the market pullback before these highs. The firm said that ‘we expect a 30% retracement of BTC during the summer, with alt coins hit the hard with up to 60% declines.’ According to the report, if the funding rates on BTC perpetual futures remain sustained above 10% then it would indicate a local top in the market and speculative excess.

The asset manager’s ambitions are even longer term. Sigel also said BTC could soar to $2.9 million per coin by 2050 and ETH could reach $22,000 by 2030 in earlier forecasts.

Other analysts are likewise close to that near-term outlook. Chief analyst at Bitget Research Ryan Lee expected a 30 percent BTC correction before a new rally. The potential pullback was linked to historical trends of market corrections in the wake of U.S. presidential inaugurations, said Lee. Donald Trump was to be elected President on January 20, 2025.

For the 2025 segment, VanEck also predicts that multiple spot crypto exchange traded products (ETPs) will be approved under new leadership at the U.S. Securities and Exchange Commission. For Bitcoin and Ethereum, we expect Ethereum ETPs to have staking options and support in kind transactions and redemptions.

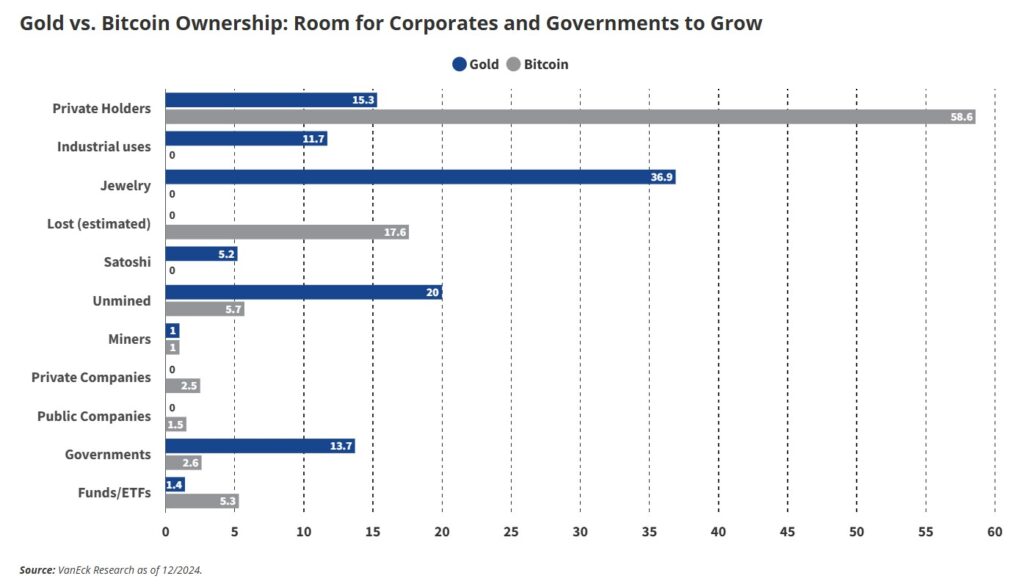

According to Sygnum Bank, institutional adoption could lead to “demand shocks” next year, leading BTC prices higher. Meanwhile, the world’s largest asset manager, BlackRock, has advised a small 2% allocation to the portfolio for investors with BTC exposure in them.

This forecast reinforces that the crypto sector is foreshadowing what will be a changed market landscape with institutional interest and regulatory clarity.